Asked by Canon Graef on May 10, 2024

Verified

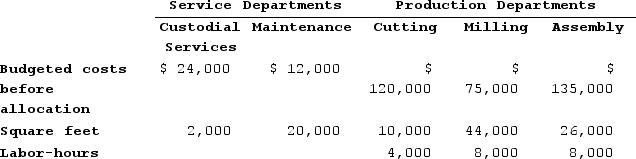

Alpha Manufacturing Corporation has two service departments, Custodial Services and Maintenance, and three production departments, Cutting, Milling, and Assembly. The company allocates the cost of Custodial Services on the basis of square footage and Maintenance on the basis of labor-hours. No distinction is made between variable and fixed costs. Budgeted operating data for the year just completed follow:

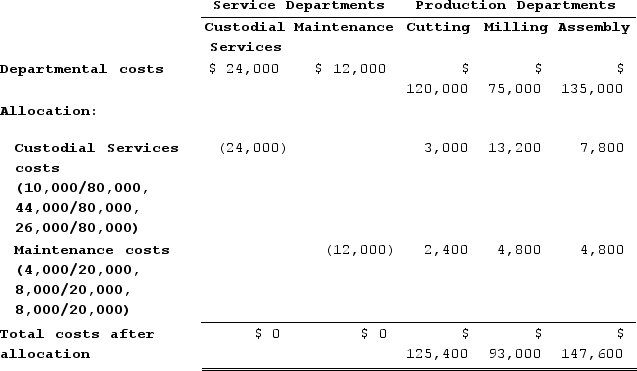

Required: a. Prepare a schedule to allocate service department costs to the production departments by the direct method.

Required: a. Prepare a schedule to allocate service department costs to the production departments by the direct method.

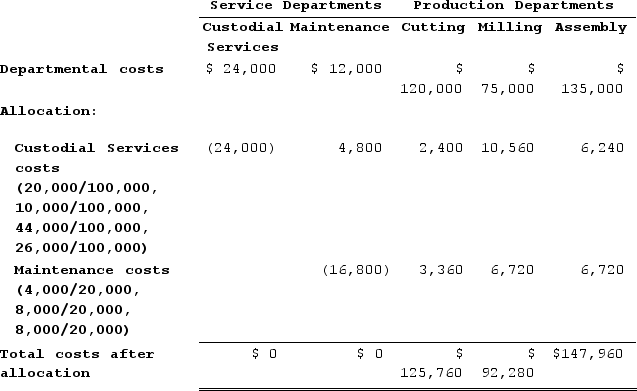

b. Prepare a schedule to allocate service department costs to the production departments by the step-down method, allocating Custodial Services first.

Direct Method

A cash flow statement preparation method that lists major categories of gross cash receipts and payments, directly showing sources and uses of cash.

Step-Down Method

An allocation method used in cost accounting to allocate service department costs to production departments in a sequential manner based on certain criteria.

Custodial Services

Services provided by companies or individuals focusing on the cleaning and maintenance of buildings or properties.

- Understand the concept of service department cost allocation.

- Prepare schedules for allocating service department costs to production/operating departments using the direct method.

Verified Answer

Allocation base for Maintenance costs = 4,000 + 8,000 + 8,000 = 20,000

b. Step MethodAllocation base for Custodial Services costs = 20,000 + 10,000 + 44,000 + 26,000 = 100,000

b. Step MethodAllocation base for Custodial Services costs = 20,000 + 10,000 + 44,000 + 26,000 = 100,000Allocation base for Maintenance costs = 4,000 + 8,000 + 8,000 = 20,000

Learning Objectives

- Understand the concept of service department cost allocation.

- Prepare schedules for allocating service department costs to production/operating departments using the direct method.

Related questions

Vitro Corporation Has Two Service Departments, Service Department a and ...

An Accounting System That Accumulates and Reports Costs Incurred by ...

The Most Useful Allocation Basis for the Departmental Costs of ...

Stoltz Corporation Uses the Direct Method to Allocate Service Department ...

Sandven Corporation Uses the Direct Method to Allocate Its Two ...