Asked by Henriette Uwimbabazi on Jul 12, 2024

Verified

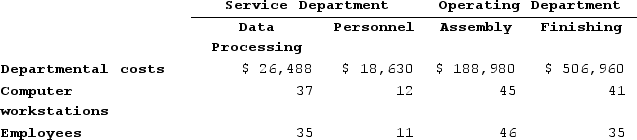

Stoltz Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Data Processing and Personnel, and two operating departments, Assembly and Finishing.  Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

A) $23,245

B) $26,488

C) $61,567

D) $16,874

Direct Method

An approach used in cost accounting or cost allocation in which costs are directly assigned to cost objects, such as departments or products, without any allocation of indirect costs.

Service Department

A division within a company that supports other departments by providing internal services or assistance.

Computer Workstations

High-performance computers designed for technical or scientific applications.

- Delve into the direct method for the distribution of costs from service departments to operating areas.

- Assess allocated costs using a direct approach.

Verified Answer

Learning Objectives

- Delve into the direct method for the distribution of costs from service departments to operating areas.

- Assess allocated costs using a direct approach.

Related questions

Sandven Corporation Uses the Direct Method to Allocate Its Two ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Whenever Possible, Service Department Costs Should Be Separated into Fixed ...

For Performance Evaluation Purposes, Variable Service Department Costs Should Be ...

Alpha Manufacturing Corporation Has Two Service Departments, Custodial Services and ...