Asked by Francine Fiscor on Jul 12, 2024

Verified

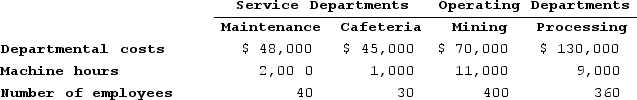

San Juan Minerals (SJM) has two service departments and two operating departments. Operating data for these departments for last year are as follows:  Costs of the Maintenance Department are allocated on the basis of machine hours. Cafeteria costs are allocated on the basis of number of employees. SJM does not distinguish between variable and fixed overhead costs.Assuming that SJM allocates service department costs using the direct method, the total cost allocated from Cafeteria to Mining would be closest to:

Costs of the Maintenance Department are allocated on the basis of machine hours. Cafeteria costs are allocated on the basis of number of employees. SJM does not distinguish between variable and fixed overhead costs.Assuming that SJM allocates service department costs using the direct method, the total cost allocated from Cafeteria to Mining would be closest to:

A) $21,687

B) $15,750

C) $23,684

D) $22,500

Direct Method

A method of allocating service departments' costs directly to production departments without intermediate allocations.

Machine Hours

Machine hours represent the total time a machine is operated within a specific period. This metric is often used in manufacturing to allocate costs based on machine usage.

Number Of Employees

The total count of individuals employed by a company, including both full-time and part-time workers.

- Compute the overall costs of departments following the allocation of service department expenses utilizing the direct approach.

- Utilize principles for allocating costs grounded in diverse criteria like square footage, workforce size, staff expenses, and labor time.

Verified Answer

First, we need to allocate the Maintenance department costs to the operating departments:

Maintenance department cost allocated to Mining = [(10,000 machine hours for Mining / 25,000 total machine hours) * $50,000 total Maintenance cost] = $20,000

Maintenance department cost allocated to Smelting = [(15,000 machine hours for Smelting / 25,000 total machine hours) * $50,000 total Maintenance cost] = $30,000

Next, we need to allocate the Cafeteria costs to the operating departments:

Cafeteria department cost allocated to Mining = [(100 employees for Mining / 250 total employees) * $40,000 total Cafeteria cost] = $16,000

Cafeteria department cost allocated to Smelting = [(150 employees for Smelting / 250 total employees) * $40,000 total Cafeteria cost] = $24,000

Therefore, the total cost allocated from Cafeteria to Mining is $16,000, and the total cost allocated from both service departments to Mining is $36,000 ($20,000 from Maintenance and $16,000 from Cafeteria).

Hence, the closest answer is (C) $23,684, which is the total cost allocated from both service departments (Maintenance and Cafeteria) to Smelting.

Learning Objectives

- Compute the overall costs of departments following the allocation of service department expenses utilizing the direct approach.

- Utilize principles for allocating costs grounded in diverse criteria like square footage, workforce size, staff expenses, and labor time.

Related questions

Strzelecki Corporation Uses the Step-Down Method to Allocate Service Department ...

Cervetti, Incorporated, Allocates Service Department Costs to Operating Departments Using ...

Sandven Corporation Uses the Direct Method to Allocate Its Two ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Stoltz Corporation Uses the Direct Method to Allocate Service Department ...