Asked by Chris Milano on May 10, 2024

Verified

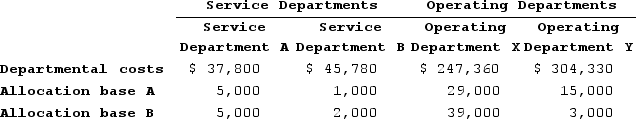

Strzelecki Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y. Data concerning those departments follow:  Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.The total Operating Department Y cost after allocations is closest to:

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.The total Operating Department Y cost after allocations is closest to:

A) $320,486

B) $318,473

C) $320,260

D) $307,660

Step-down Method

The step-down method is an accounting practice used to allocate costs among departments, beginning with the highest cost pool.

Allocation Base A

An allocation base is a measure or quantity, such as machine hours or labor costs, used to assign indirect costs to different products or services.

Allocation Base B

A criterion or standard used to distribute overhead costs among various cost objects.

- Resolve the total departmental charges after dividing service department costs using the step-down approach.

- Execute principles for distributing costs founded on multiple bases such as spatial size, personnel numbers, employee-related expenditures, and labor hours employed.

- Review the effects of cost dispersal on the financial expenditures of operational divisions.

Verified Answer

Step 1: Allocate Service Department A costs to Service Department B and Operating Department X

Total Service Department A costs = $150,000

Allocation base A (number of employees) = 50 employees in Service Department A and 100 employees in Service Department B

Allocation rate = $150,000 / 50 employees = $3,000 per employee

Service Department A cost allocated to Service Department B = 100 employees x $3,000 per employee = $300,000

Service Department A cost allocated to Operating Department X = 50 employees x $3,000 per employee = $150,000

Step 2: Allocate Service Department B costs to Operating Department X and Operating Department Y

Total Service Department B costs = $200,000

Allocation base B (number of machine hours) = 10,000 machine hours in Operating Department X and 20,000 machine hours in Operating Department Y

Allocation rate = $200,000 / 30,000 machine hours = $6.67 per machine hour

Service Department B cost allocated to Operating Department X = 10,000 machine hours x $6.67 per machine hour = $66,700

Service Department B cost allocated to Operating Department Y = 20,000 machine hours x $6.67 per machine hour = $133,300

Total Operating Department Y cost after allocations = Operating Department Y direct cost + Service Department A allocation + Service Department B allocation

= $120,000 + $0 + $133,300

= $253,300

Therefore, the closest option is C) $320,260.

Learning Objectives

- Resolve the total departmental charges after dividing service department costs using the step-down approach.

- Execute principles for distributing costs founded on multiple bases such as spatial size, personnel numbers, employee-related expenditures, and labor hours employed.

- Review the effects of cost dispersal on the financial expenditures of operational divisions.

Related questions

San Juan Minerals (SJM) Has Two Service Departments and Two ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Cervetti, Incorporated, Allocates Service Department Costs to Operating Departments Using ...

Muckenfuss Clinic Uses the Step-Down Method to Allocate Service Department ...

The Step-Down Method of Service Department Cost Allocation Ignores Interdepartmental ...