Asked by Robert Grady on May 29, 2024

Verified

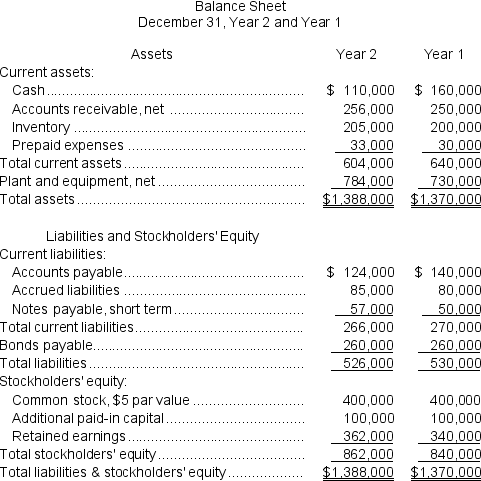

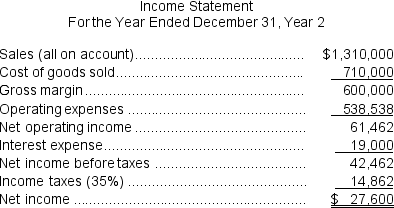

Gehlhausen Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.

Dividends on common stock during Year 2 totaled $5,600.The market price of common stock at the end of Year 2 was $5.60 per share.

Required:

a.What is the company's net profit margin percentage for Year 2?

b.What is the company's gross margin percentage for Year 2?

c.What is the company's return on total assets for Year 2?

d.What is the company's return on equity for Year 2?

Return on Total Assets

A financial ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets.

Net Profit Margin Percentage

A profitability metric that calculates the percentage of net income derived from revenue, indicating how much of each dollar in revenue results in profit.

Return on Equity

A measure of financial performance calculated by dividing net income by shareholders' equity, indicating how effectively management is using a company's assets to create profits.

- Master and employ assorted financial measures to determine a company's financial stability.

- Determine the percentage of net profit margin to gauge financial efficiency compared to revenue.

- Gain comprehension of how gross margin percentage is instrumental in assessing the financial health of a company.

Verified Answer

= $27,600 ÷ $1,310,000 = 2.1% (rounded)

b.Gross margin percentage = Gross margin ÷ Sales

= $600,000 ÷ $1,310,000 = 45.8% (rounded)

c.Return on total assets = Adjusted net income* ÷ Average total assets**

= $39,950 ÷ $1,379,000 = 2.90% (rounded)

*Adjusted net income = Net income + [Interest expense × (1 - Tax rate)]

= $27,600 + [$19,000 × (1 - 0.35)] = $39,950

**Average total assets = ($1,388,000 + $1,370,000)÷ 2 = $1,379,000

d.Return on equity = Net income ÷ Average stockholders' equity*

= $27,600 ÷ $851,000 = 3.24% (rounded)

*Average stockholders' equity = ($862,000 + $840,000)÷ 2 = $851,000

Learning Objectives

- Master and employ assorted financial measures to determine a company's financial stability.

- Determine the percentage of net profit margin to gauge financial efficiency compared to revenue.

- Gain comprehension of how gross margin percentage is instrumental in assessing the financial health of a company.

Related questions

Remley Corporation Has Provided the Following Financial Data ...

Sidell Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Hagle Corporation Has Provided the Following Financial Data ...

Based Upon the Following Information, Which Company Has the Best ...

Which One of the Following Ratios Helps to Indicate a ...