Asked by Analise Johnson on May 21, 2024

Verified

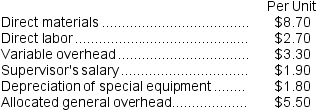

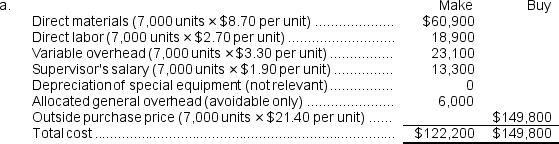

Part U67 is used in one of Broce Corporation's products.The company's Accounting Department reports the following costs of producing the 7,000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $21.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to make the part and sell it to the company for $21.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6,000 of these allocated general overhead costs would be avoided.

Required:

a.Prepare a report that shows the financial impact of buying part U67 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Special Equipment

Specialized tools or machinery designed for specific industrial or commercial activities, often requiring significant investment and expertise to operate.

Allocated General Overhead

Distribution of indirect costs to various departments or production processes within an organization.

Variable Costs

Costs that change in proportion to the level of activity or volume of production.

- Absorb the fundamentals of outsourcing and the deliberations regarding the options of producing in-house or procuring.

Verified Answer

MW

Michael WilliamsMay 28, 2024

Final Answer :  b.The total cost of the make alternative is lower by $27,600.Therefore, the company should continue to make the part itself.

b.The total cost of the make alternative is lower by $27,600.Therefore, the company should continue to make the part itself.

b.The total cost of the make alternative is lower by $27,600.Therefore, the company should continue to make the part itself.

b.The total cost of the make alternative is lower by $27,600.Therefore, the company should continue to make the part itself.

Learning Objectives

- Absorb the fundamentals of outsourcing and the deliberations regarding the options of producing in-house or procuring.