Asked by Oscar Zamora on May 06, 2024

Verified

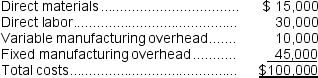

McGraw Company uses 5,000 units of Part X each year as a component in the assembly of one of its products.The company is presently producing Part X internally at a total cost of $100,000, computed as follows:  An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

An outside supplier has offered to provide Part X at a price of $18 per unit.If McGraw Company stops producing the part internally, one-third of the fixed manufacturing overhead would be eliminated.Assume that direct labor is a variable cost.

Required:

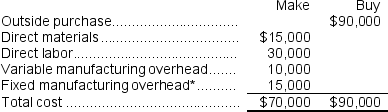

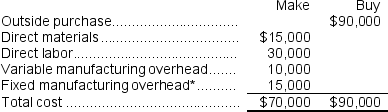

Prepare an analysis showing the annual financial advantage or disadvantage of accepting the outside supplier's offer.

Fixed Manufacturing Overhead

Costs associated with manufacturing that do not vary with the level of production, such as rent, salaries, and insurance.

Variable Cost

Costs that change in proportion to the level of production or sales volume.

Outside Supplier

A third-party entity that provides goods or services to a company, typically not affiliated with the company's internal supply chain.

- Acquire a knowledge on the theory of outsourcing and the determination between manufacturing or purchasing.

Verified Answer

HS

hector salinasMay 10, 2024

Final Answer :  * 1/3 × $45,000 = $15,000

* 1/3 × $45,000 = $15,000

The annual financial advantage of making the parts is $20,000.

* 1/3 × $45,000 = $15,000

* 1/3 × $45,000 = $15,000The annual financial advantage of making the parts is $20,000.

Learning Objectives

- Acquire a knowledge on the theory of outsourcing and the determination between manufacturing or purchasing.