Asked by Jaiona Sessoms on May 12, 2024

Verified

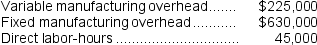

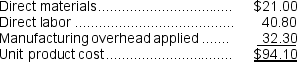

Gottshall Inc.makes a range of products.The company's predetermined overhead rate is $19 per direct labor-hour, which was calculated using the following budgeted data:  Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:

Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:  An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.

An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.

Required:

Is the offer from the outside supplier financially attractive? Why?

Predetermined Overhead Rate

A rate used to charge manufacturing overhead cost to jobs that is established in advance for each period. It is computed by dividing the estimated total manufacturing overhead cost for the period by the estimated total amount of the allocation base for the period.

- Understand the concept of outsourcing and make-or-buy decisions.

Verified Answer

MS

Mohamed SalehMay 16, 2024

Final Answer :

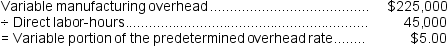

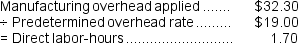

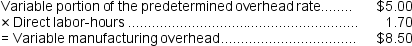

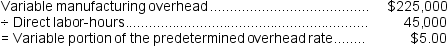

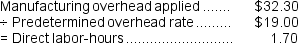

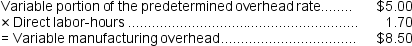

Direct materials, direct labor, and variable manufacturing overhead are relevant in this decision.Fixed manufacturing overhead is not relevant because it would not be affected by the decision.The variable portion of the manufacturing overhead rate is computed as follows:  The direct-labor hours per unit for the special order can be determined as follows:

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

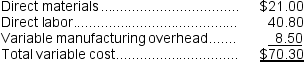

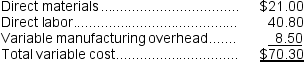

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:  Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

The direct-labor hours per unit for the special order can be determined as follows:

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:  Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

Learning Objectives

- Understand the concept of outsourcing and make-or-buy decisions.