Asked by Haseeb Akhtar on Jun 16, 2024

Verified

On September 30,Waldon Co.has $540,250 of accounts receivable.Waldon uses the allowance method of accounting for bad debts and has an existing credit balance in the allowance for doubtful accounts of $13,750.

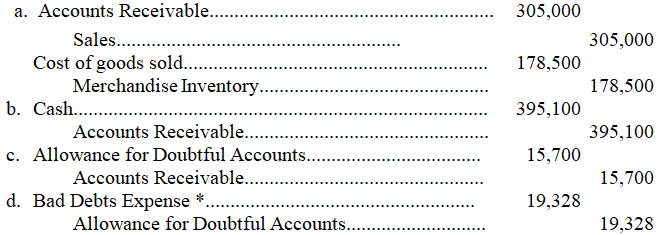

1.Prepare journal entries to record the following selected October transactions.The company uses the perpetual inventory system.

a.Sold $305,000 of merchandise (that cost $178,500)to customers on credit.

b.Received $395,100 cash in payment of accounts receivable.

c.Wrote off $15,700 of uncollectible accounts receivable.

d.In adjusting the accounts on October 31,its fiscal year-end,the company estimated that 4.0% of accounts receivable will be uncollectible.

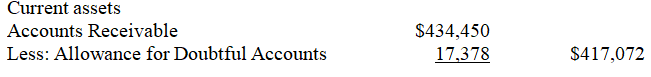

2.Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its October 31 balance sheet.

Allowance Method

An accounting method used to estimate and deduct accounts receivable that are deemed to be uncollectible.

Uncollectible Accounts

Accounts receivable that are considered irrecoverable and are written off as a loss by a business.

Perpetual Inventory System

A method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

- Grasp the essential doctrines and procedural steps in the accounting of uncollectible accounts receivable.

- Cultivate proficiency in the creation of journal entries for transactions involving bad debts and note receivables.

- Delve into the methods for forecasting bad debts expense, including detailed study of the allowance method and the direct write-off method.

Verified Answer

* $540,250 + $305,000 - $395,100 - 15,700 = $434,450 ending Accounts Receivable

Allowance for doubtful accounts before adjustment= $13,750 - $15,700 = $1,950 debit

Uncollectible = $434,450 * .04 = $17,378; $17,378 + $1,950 = $19,328 bad debt expense

2.

Learning Objectives

- Grasp the essential doctrines and procedural steps in the accounting of uncollectible accounts receivable.

- Cultivate proficiency in the creation of journal entries for transactions involving bad debts and note receivables.

- Delve into the methods for forecasting bad debts expense, including detailed study of the allowance method and the direct write-off method.

Related questions

A Company Has the Following Unadjusted Account Balances at December ...

The Following Series of Transactions Occurred During Year 1 and ...

Thatcher Company Had a January 1,credit Balance in Its Allowance ...

Prepare General Journal Entries for the Following Transactions of Norman ...

At December 31 of the Current Year,a Company Reported the ...