Asked by Jesica Alarcon on Jun 17, 2024

Verified

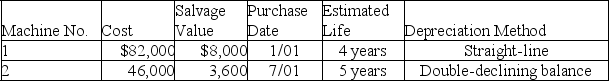

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Double-Declining-Balance

A method of accelerated depreciation that doubles the regular depreciation rate, reducing the value of an asset more quickly in its earlier years.

Salvage Value

The projected remaining worth of an asset upon the conclusion of its operational lifespan, frequently accounted for in determining depreciation.

Depreciation Expense

An accounting method allocating the cost of a tangible asset over its useful life.

- Understand and calculate the depreciation expense using different methods such as straight-line, double-declining-balance, and units-of-production.

Verified Answer

Years 1 & 2: [($82,000 - $8,000)/4] = $18,500

Machine 2:

Year 1: $46,000 x 40% * 6/12 = $9,200

Year 2: ($46,000 - $9,200)* 40% = $14,720

* DDB depreciation rate = 1/5 * 2 = 40%

Learning Objectives

- Understand and calculate the depreciation expense using different methods such as straight-line, double-declining-balance, and units-of-production.

Related questions

Explain the Purpose of and Method of Depreciation for Partial ...

The Oberon Company Purchased a Delivery Truck for $95,000 on ...

Explain in Detail How to Compute Each of the Following ...

On September 30 of the Current Year,a Company Acquired and ...

A Company's Property Records Revealed the Following Information About One ...