Asked by Ashley Elizabeth on Jun 14, 2024

Verified

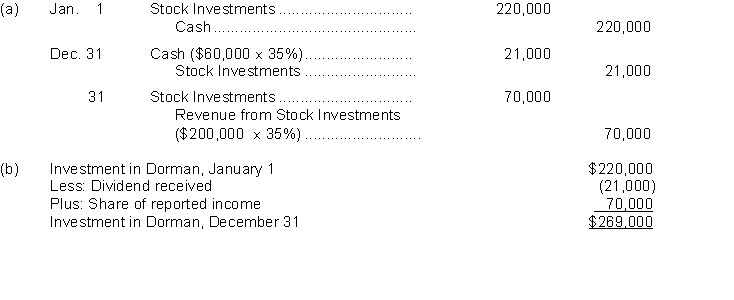

On January 1 Jarret Corporation purchased a 35% equity in Dorman Corporation for $220000. At December 31 Dorman declared and paid a $60000 cash dividend and reported net income of $200000.

Instructions

(a) Journalize the transactions.

(b) Determine the amount to be reported as an investment in Dorman stock at December 31.

Equity Interest

Ownership interest in a company, usually in the form of stocks, representing a share of the earnings and assets of the business.

Cash Dividend

A payment made by a corporation to its shareholders, usually in the form of cash.

Net Income

The profit a company retains after all financial obligations, like costs and taxes, are subtracted from its total income.

- Acquire knowledge of how to account for and document transactions related to the acquisition of equity and debt investments.

- Explain the discrepancies between the equity and cost methods in investment accounting.

Verified Answer

Learning Objectives

- Acquire knowledge of how to account for and document transactions related to the acquisition of equity and debt investments.

- Explain the discrepancies between the equity and cost methods in investment accounting.

Related questions

Presented Below Are Two Independent Situations ...

On February 1 Brutus Company Purchased 1000 Shares (2% Ownership) ...

On January 1 Sanchez Corporation Purchased a 35% Equity Interest ...

Rosco Company Purchased 35000 Shares of Common Stock of Paxton ...

On January 5 2017 Grouse Company Purchased the Following Stock \(\$ ...