Asked by astrid truluck on May 28, 2024

Verified

Presented below are two independent situations.

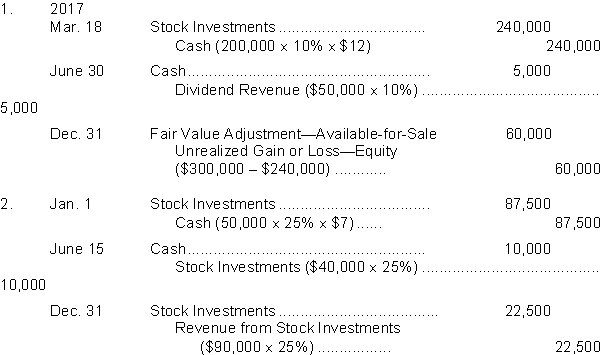

1. Guo Cosmetics acquired 10% of the 200000 shares of common stock of Chy Fashion at a total cost of $12 per share on March 18 2017. On June 30 Chy declared and paid a $50000 dividend. On December 31 Chy reported net income of $110000 for the year. At December 31 the market price of Chy Fashion was $15 per share. The stock is classified as available-for-sale.

2. Liptin Inc. obtained significant influence over Blurr Corporation by buying 25% of Blurr 50000 outstanding shares of common stock at a total cost of $7 per share on January 1 2017. On June 15 Blurr declared and paid a cash dividend of $40000. On December 31 Blurr reported a net income of $90000 for the year.

Instructions

Prepare all the necessary journal entries for 2014 for (a) Guo Cosmetics and (b) Liptin Inc.

Available-For-Sale

A classification of securities which are not actively traded by the company, with changes in value reported in other comprehensive income.

Significant Influence

The power to participate in the financial and operating policy decisions of another entity, but not control those policies.

Net Income

The amount of profit a company has left over after paying all its expenses and taxes.

- Gain an understanding of the accounting processes and the recording of transactions for equity and debt investment purchases.

- Examine the impact of receiving dividends and accruing interest on investments within the context of financial reporting.

- Identify the differences between equity and cost accounting methods for investments.

Verified Answer

Learning Objectives

- Gain an understanding of the accounting processes and the recording of transactions for equity and debt investment purchases.

- Examine the impact of receiving dividends and accruing interest on investments within the context of financial reporting.

- Identify the differences between equity and cost accounting methods for investments.

Related questions

At December 31 2017 the Trading Securities for Eddy Company ...

An Unrealized Gain or Loss on Available-For-Sale Securities Is Reported ...

On April 25 Davis Company Buys 4200 Shares of Carter ...

Plotner Corporation Has the Following Trading Portfolio of Stock Investments ...

At the End of an Accounting Period If the Fair ...