Asked by caglar gokbulut on May 22, 2024

Verified

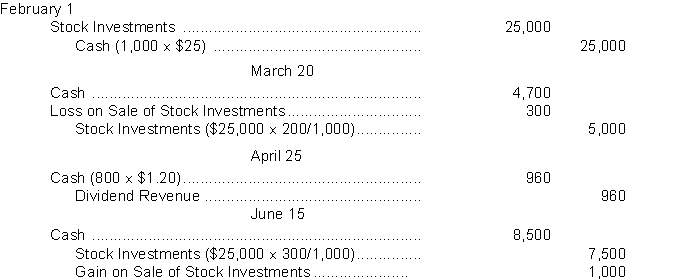

On February 1 Brutus Company purchased 1000 shares (2% ownership) of Wynne Company common stock for $25 per share. On March 20 Brutus Company sold 200 shares of Wynne stock for $4700. Brutus received a dividend of $1.20 per share on April 25. On June 15 Marcus sold 300 shares of Wynne stock for $8500.

Instructions

Prepare the journal entries to record the transactions described above.

Common Stock

A type of equity security that represents ownership in a corporation, with rights to share in its profits through dividends and capital appreciation.

Sold Shares

Refers to the act of transferring ownership in a corporation's stock from one party to another in exchange for money or other compensation.

Dividend

A portion of a company's earnings that is distributed to shareholders as a return on their investment.

- Learn the methodology of accounting and making journal entries for the purchase of equity and debt instruments.

- Comprehend the consequences of liquidating portions of investments, inclusive of computing gains and losses.

Verified Answer

Learning Objectives

- Learn the methodology of accounting and making journal entries for the purchase of equity and debt instruments.

- Comprehend the consequences of liquidating portions of investments, inclusive of computing gains and losses.

Related questions

On April 25 Davis Company Buys 4200 Shares of Carter ...

On January 1 Sanchez Corporation Purchased a 35% Equity Interest ...

Presented Below Are Two Independent Situations ...

On January 5 2017 Grouse Company Purchased the Following Stock \(\$ ...

Rosco Company Purchased 35000 Shares of Common Stock of Paxton ...