Asked by Elaine Burnside on May 07, 2024

Verified

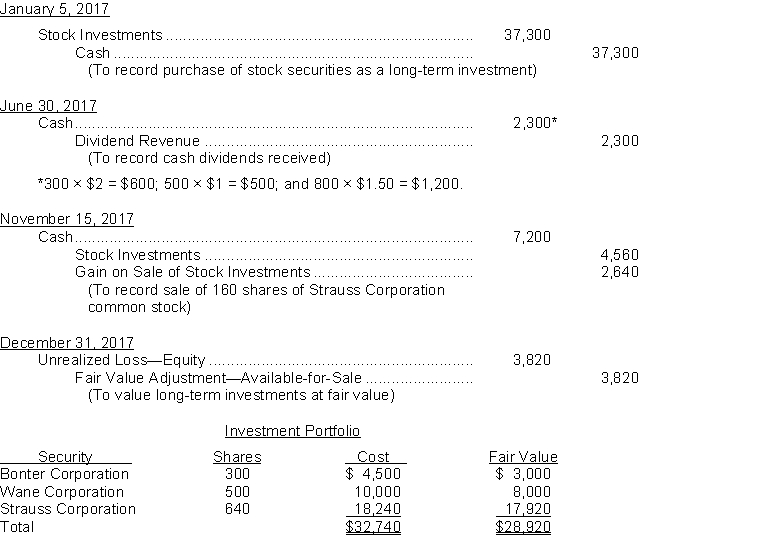

On January 5 2017 Grouse Company purchased the following stock securities as a long-term investment: 300 shares Bonter Corporation common stock for $4,500\$ 4,500$4,500 .

500 shares Wane Corporation common stock for $10,000\$ 10,000$10,000 .

800 shares Strauss Corporation common stock for $22,800\$ 22,800$22,800 . Assume that Grouse Company cannot exercise significant influence over the activities of the investee companies and that the cost method is used to account for the investments.

On June 30 2017 Grouse Company received the following cash dividends: Bonter Corporation. $2.00 per share Wane Corporation $1.00 per share Strauss Corporation $1.50 per share\begin{array}{llr} \text { Bonter Corporation. } &\$2.00\text { per share}\\ \text { Wane Corporation } &\$1.00\text { per share}\\ \text { Strauss Corporation } &\$1.50\text { per share}\end{array} Bonter Corporation. Wane Corporation Strauss Corporation $2.00 per share$1.00 per share$1.50 per share

On November 15 2017 Grouse Company sold 160 shares of Strauss Corporation common stock for $7200.

On December 31 2017 the fair value of the securities held by Grouse Company is as follows: Per Share ‾ Bonter Corporation common stock $10 Wane Corporation common stock 16 Strauss Corporation common stock 28\begin{array} { l c } &\underline{ \text { Per Share }} \\ \text { Bonter Corporation common stock } & \$ 10 \\\text { Wane Corporation common stock } & 16 \\\text { Strauss Corporation common stock } & 28\end{array} Bonter Corporation common stock Wane Corporation common stock Strauss Corporation common stock Per Share $101628 Instructions

Prepare the appropriate journal entries that Grouse Company should make on the following dates: January 5, 2017

June 30, 2017

November 15, 2017

December 31, 2017

Stock Securities

Equities or shares in corporations, representing a fraction of ownership in the company; these can provide dividends and potential appreciation in value to its holders.

Long-Term Investment

Investments in securities or other assets that are intended to be held for several years or more.

Cash Dividends

Payments made by a corporation to its shareholders as a distribution of profits, typically in cash form, reflecting the company's profitability.

- Absorb the principles of accounting and transaction recording for the procurement of equity and debt investments.

- Evaluate the implications of dividend income and accrued interest on investment portfolios for the purposes of financial reporting.

- Differentiate between the cost method and equity method for accounting investments.

Verified Answer

Learning Objectives

- Absorb the principles of accounting and transaction recording for the procurement of equity and debt investments.

- Evaluate the implications of dividend income and accrued interest on investment portfolios for the purposes of financial reporting.

- Differentiate between the cost method and equity method for accounting investments.

Related questions

On February 1 Brutus Company Purchased 1000 Shares (2% Ownership) ...

On January 1 2017 Mink Company Purchased 5000 Shares of ...

On January 1 Jarret Corporation Purchased a 35% Equity in ...

When an Investor Owns Between 20% and 50% of the ...

Under the Cost Method Dividends Received from an Investee Company ...