Asked by Zachary Wages on May 02, 2024

Verified

On January 1,a company purchased machinery for $75,000 that had a 6-year useful life and a salvage value of $6,000.After three years of straight-line depreciation,the company paid $8,500 cash at the beginning of the year to improve the efficiency of the machinery.The productivity of the machinery was improved without increasing its remaining useful life or changing its salvage value.Straight-line depreciation is used throughout the machinery's life.

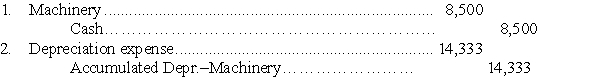

1.Prepare the journal entry to record the $8,500 expenditure.

2.Prepare the journal entry to record depreciation expense for the fourth year.

Straight-Line Depreciation

A strategy for dividing the cost of a substantial asset through its operational life in even yearly portions.

Productivity

The measure of efficiency of a person, machine, factory, system, etc., in converting inputs into useful outputs.

Machinery

Industrial or commercial equipment designed to perform specific tasks, often part of the manufacturing or production process.

- Determine and log the depreciation charges for fixed assets through multiple methodologies.

- Calculate the effects of enhancements and upgrades to tangible assets on their depreciation.

Verified Answer

Learning Objectives

- Determine and log the depreciation charges for fixed assets through multiple methodologies.

- Calculate the effects of enhancements and upgrades to tangible assets on their depreciation.

Related questions

A Company Paid $320,000 for Equipment That Was Expected to ...

A Company Purchased a Cooling System on January 2 for ...

A New Machine Costing $1,800,000 Cash and Estimated to Have ...

On April 1,2015,due to Obsolescence Resulting from a New Technology,a ...

A Company Purchased and Installed Machinery on January 1 at ...