Asked by Daisy Terrado on Jul 21, 2024

Verified

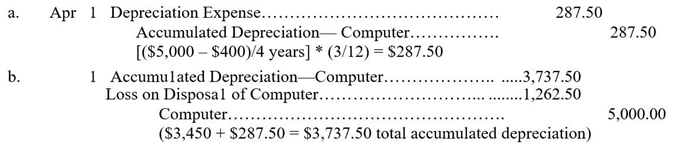

On April 1,2015,due to obsolescence resulting from a new technology,a company discarded a computer that cost $5,000,had a useful life of 4 years,and a salvage value of $400.Based on straight-line depreciation,the accumulated depreciation as of December 31,2014 was $3,450.

a.Prepare the journal entry to record depreciation up to the date of disposal of the computer.

b.Prepare the journal entry to record the disposal of the computer.

Straight-Line Depreciation

A procedure for spreading out the cost of a solid asset over the duration of its usability in equal annual payments.

Obsolescence

The process or condition of a product or component becoming outdated or no longer useful due to advancements or changes in technology, market demand, or other factors.

Salvage Value

The anticipated recovery value of an asset after its period of usefulness ends.

- Determine the profit or deficit resulting from the sale of fixed assets.

- Measure and record the diminution in value of permanent assets employing different approaches.

Verified Answer

Learning Objectives

- Determine the profit or deficit resulting from the sale of fixed assets.

- Measure and record the diminution in value of permanent assets employing different approaches.

Related questions

The Federal Income Tax Rules for Depreciating Assets Are Known ...

On January 1,2016,a Company Disposed of Equipment for $16,200 Cash ...

A Company Purchased and Installed Machinery on January 1 at ...

On January 1,a Company Purchased Machinery for $75,000 That Had ...

A New Machine Costing $1,800,000 Cash and Estimated to Have ...