Asked by Anaelle Gauthier on Jun 17, 2024

Verified

A company purchased a cooling system on January 2 for $225,000.The system had an estimated useful life of 15 years.After using the system for 13 full years,the company completed a renovation of the system at a cost of $33,000 and now expects the system to be more efficient and last 8 years beyond the original estimate.The company uses the straight-line method of depreciation.

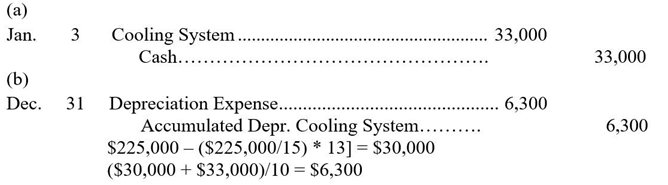

(a)Prepare the journal entry at January 3,to record the renovation of the cooling system.

(b)Prepare the journal entry at December 31,to record the revised depreciation for the thirteenth year.

Cooling System

A mechanism utilized in various technologies to remove heat from components or environments, ensuring optimal operation or comfort.

Straight-Line Method

A method of calculating depreciation by evenly spreading the cost of an asset over its useful life.

Depreciation

The process of allocating the cost of tangible assets over their useful lives.

- Calculate and record depreciation expenses for fixed assets using various methods.

- Account for renovations and improvements to fixed assets and their impact on depreciation.

Verified Answer

AS

Learning Objectives

- Calculate and record depreciation expenses for fixed assets using various methods.

- Account for renovations and improvements to fixed assets and their impact on depreciation.

Related questions

A New Machine Costing $1,800,000 Cash and Estimated to Have ...

A Company Paid $320,000 for Equipment That Was Expected to ...

On January 1,a Company Purchased Machinery for $75,000 That Had ...

A Company Purchased and Installed Machinery on January 1 at ...

The Federal Income Tax Rules for Depreciating Assets Are Known ...