Asked by Dalvin Mitchell on Jul 16, 2024

Verified

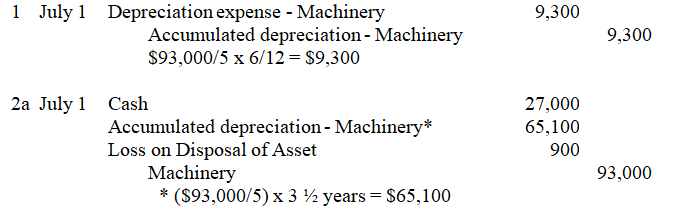

A company purchased and installed machinery on January 1 at a total cost of $93,000.Straight-line depreciation was calculated based on the assumption of a five-year life and no salvage value.The machinery was disposed of on July 1 of year four.The company uses the calendar year.

1.Prepare the general journal entry to update depreciation to July 1 in year four.

2.Prepare the general journal entry to record the sale of the machine for $27,000 cash.

Straight-Line Depreciation

An approach to apportion the price of a tangible property over its effective life in consistent annual installments.

Machinery

Machinery refers to machines or machine systems collectively, which are used in various industries for manufacturing or other operations.

Calendar Year

The one-year period that begins on January 1st and ends on December 31st, used in most accounting and financial calculations.

- Appraise and document the wear and tear costs for tangible assets employing a range of methodologies.

- Compile general journal entries to outline transactions connected to plant assets.

Verified Answer

Learning Objectives

- Appraise and document the wear and tear costs for tangible assets employing a range of methodologies.

- Compile general journal entries to outline transactions connected to plant assets.

Related questions

On April 1,2015,due to Obsolescence Resulting from a New Technology,a ...

A New Machine Costing $1,800,000 Cash and Estimated to Have ...

During the Current Year,a Company Exchanged an Old Truck Costing ...

A Company Paid $320,000 for Equipment That Was Expected to ...

The Federal Income Tax Rules for Depreciating Assets Are Known ...