Asked by Talyn Rhodes on Jun 15, 2024

Verified

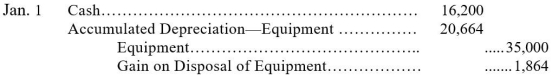

On January 1,2016,a company disposed of equipment for $16,200 cash that had cost $35,000,a salvage value of $5,000,and a useful life 10 years.The double-declining-balance depreciation method was used.On December 31,2015,accumulated depreciation was $20,664.Prepare a journal entry to record the disposal of the equipment.

Double-Declining-Balance

An accelerated depreciation technique that applies twice the depreciation rate of straight-line depreciation to hasten the reduction in an asset's recorded value.

Salvage Value

The estimated residual value of an asset after its useful life has ended, used in calculating depreciation.

Useful Life

The estimated period over which an asset is expected to be usable by an entity, contributing to its cash flows.

- Calculate the gain or loss on the disposal of fixed assets.

Verified Answer

Learning Objectives

- Calculate the gain or loss on the disposal of fixed assets.

Related questions

On April 1,2015,due to Obsolescence Resulting from a New Technology,a ...

On April 1 of the Current Year,a Company Disposed of ...

If a Plant Asset Is Retired Before It Is Fully ...

On July 1 2017 Hale Kennels Sells Equipment for $220000 ...

Devine Company Sold a Machine That Originally Cost $34,000 and ...