Asked by Lindsey Norberg on Apr 29, 2024

Verified

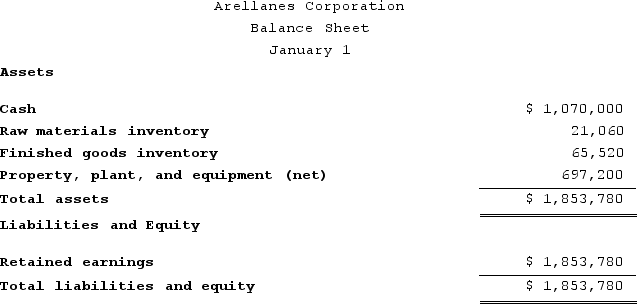

Arellanes Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

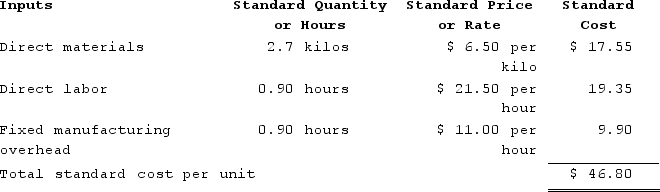

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $198,000 and budgeted activity of 18,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $198,000 and budgeted activity of 18,000 hours.

During the year, the company completed the following transactions:

a. Purchased 75,900 kilos of raw material at a price of $6.40 per kilo.b. Used 68,680 kilos of the raw material to produce 25,400 units of work in process.c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 24,160 hours at an average cost of $19.80 per hour.d. Applied fixed overhead to the 25,400 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $187,400. Of this total, $95,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $92,000 related to depreciation of manufacturing equipment.e. Transferred 25,400 units from work in process to finished goods.f. Sold for cash 24,200 units to customers at a price of $52.80 per unit.g. Completed and transferred the standard cost associated with the 24,200 units sold from finished goods to cost of goods sold.h. Paid $121,000 of selling and administrative expenses.i. Closed all standard cost variances to cost of goods sold.

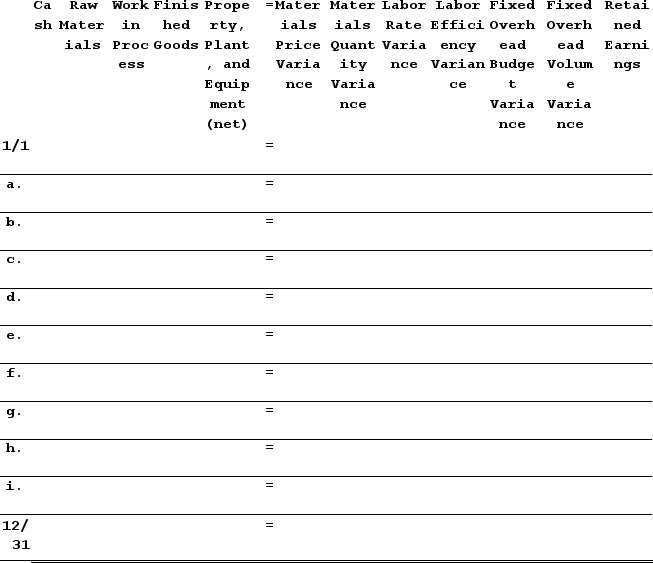

Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below.

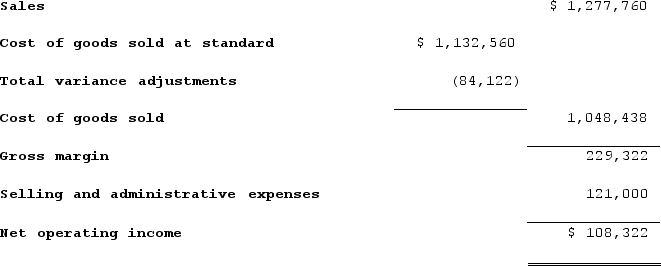

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

Standard Cost System

A system of accounting that uses cost standards for costing materials, labor, and overhead.

Fixed Manufacturing Overhead Rate

This refers to the rate at which all fixed manufacturing costs are allocated across units produced, typically calculated at the beginning of a fiscal period.

Variances

The difference between planned or expected financial outcomes and the actual results.

- Determine assorted variances linked to manufacturing overhead, encompassing budget, volume, rate, and efficiency variances.

- Investigate the financial impact of standard versus actual cost discrepancies in the manufacturing industry.

- Acquire proficiency in composing comprehensive standard costing analyses, encompassing variance analysis.

Verified Answer

Materials quantity variance:Standard quantity = Actual output × Standard quantity = 25,400 units × 2.7 kilos per unit = 68,580 kilosMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (68,680 kilos − 68,580 kilos) × $6.50 per kilo= (100 kilos) × $6.50 per kilo= $650 Unfavorable

Labor rate variance = Actual hours × (Actual rate − Standard rate)= 24,160 hours × ($19.80 per hour − $21.50 per hour)= 24,160 hours × (−$1.70 per hour)= $41,072 Favorable

Labor efficiency variance:Standard hours = Actual output × Standard quantity = 25,400 units × 0.90 hours per unit = 22,860 hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= (24,160 hours − 22,860 hours) × $21.50 per hour= (1,300 hours) × $21.50 per hour= $27,950 Unfavorable

Budget variance = Actual fixed overhead − Budgeted fixed overhead= $187,400 − $198,000= $10,600 Favorable

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= $198,000 − (22,860 hours × $11.00 per hour)= $198,000 − ($251,460)= $53,460 Favorable

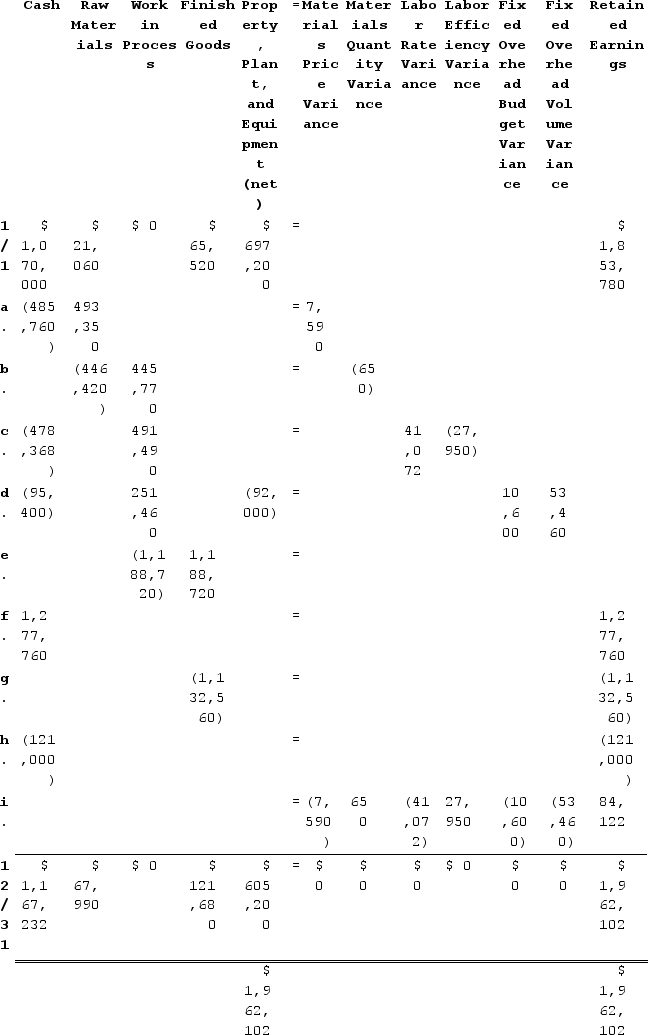

2. & 3.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 75,900 kilos × $6.40 per kilo = $485,760. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 75,900 kilos × $6.50 per kilo = $493,350. The materials price variance is $7,590 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 68,680 kilos × $6.50 per kilo = $446,420. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (25,400 units × 2.7 kilos per unit) × $6.50 per kilo = 68,580 kilos × $6.50 per kilo = $445,770. The difference is the Materials Quantity Variance which is $650 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 24,160 hours × $19.80 per hour = $478,368. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (25,400 units × 0.90 hours per unit) × $21.50 per hour = 22,860 hours × $21.50 per hour = $491,490. The difference consists of the Labor Rate Variance which is $41,072 Favorable and the Labor Efficiency Variance which is $27,950 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $95,400. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (25,400 units × 0.90 hours per unit) × $11.00 per hour = 22,860 hours × $11.00 per hour = $251,460. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $92,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,600 Favorable and the Fixed Overhead (FOH) Volume Variance which is $53,460 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 25,400 units × $46.80 per unit = $1,188,720. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 24,200 units × $52.80 per unit = $1,277,760. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 24,200 units × $46.80 per unit = $1,132,560. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $121,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 75,900 kilos × $6.40 per kilo = $485,760. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 75,900 kilos × $6.50 per kilo = $493,350. The materials price variance is $7,590 Favorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 68,680 kilos × $6.50 per kilo = $446,420. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (25,400 units × 2.7 kilos per unit) × $6.50 per kilo = 68,580 kilos × $6.50 per kilo = $445,770. The difference is the Materials Quantity Variance which is $650 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 24,160 hours × $19.80 per hour = $478,368. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (25,400 units × 0.90 hours per unit) × $21.50 per hour = 22,860 hours × $21.50 per hour = $491,490. The difference consists of the Labor Rate Variance which is $41,072 Favorable and the Labor Efficiency Variance which is $27,950 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $95,400. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (25,400 units × 0.90 hours per unit) × $11.00 per hour = 22,860 hours × $11.00 per hour = $251,460. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $92,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $10,600 Favorable and the Fixed Overhead (FOH) Volume Variance which is $53,460 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 25,400 units × $46.80 per unit = $1,188,720. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 24,200 units × $52.80 per unit = $1,277,760. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 24,200 units × $46.80 per unit = $1,132,560. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $121,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).4.

Learning Objectives

- Determine assorted variances linked to manufacturing overhead, encompassing budget, volume, rate, and efficiency variances.

- Investigate the financial impact of standard versus actual cost discrepancies in the manufacturing industry.

- Acquire proficiency in composing comprehensive standard costing analyses, encompassing variance analysis.

Related questions

Eastern Company Uses a Standard Cost System in Which Manufacturing ...

Yordy Corporation Manufactures One Product ...

Modine Corporation Has Provided the Following Data for September ...

Lanciotti Corporation Manufactures One Product ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...