Asked by Gruia Ghiroaga on Apr 26, 2024

Verified

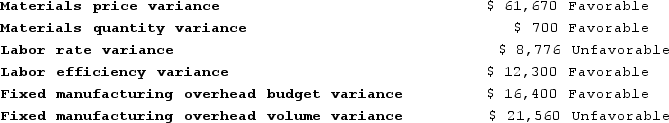

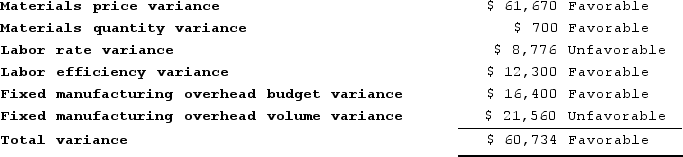

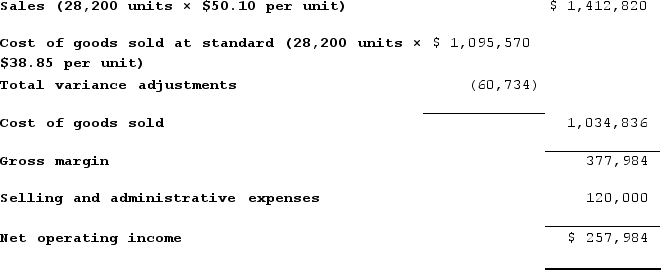

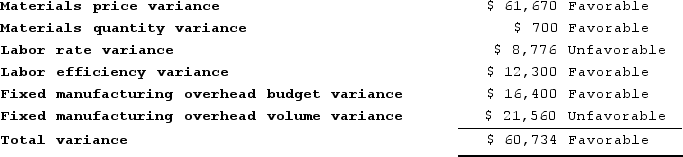

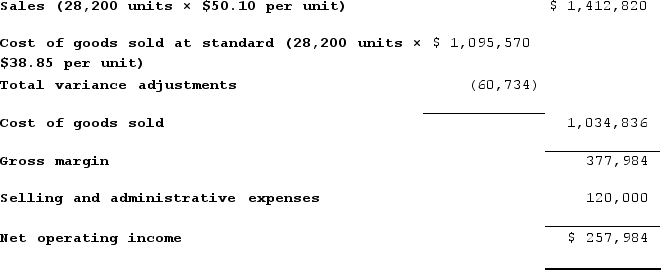

Grafton Corporation manufactures one product. It does not maintain any beginning or ending inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. Its standard cost per unit produced is $38.85. During the year, the company produced and sold 28,200 units at a price of $50.10 per unit and its selling and administrative expenses totaled $120,000. The company does not have any variable manufacturing overhead costs. It recorded the following variances during the year:

Required:Prepare an income statement for the year.

Required:Prepare an income statement for the year.

Standard Cost System

An accounting method that uses predetermined costs for valuing inventory and recognizes variances between these costs and actual costs.

Cost of Goods Sold

The primary costs involved in the production of goods a company deals in, including the expenses for materials and labor.

Variances

Differences between planned, budgeted, or standard costs and actual costs, used in performance measurement and control.

- Review the economic ramifications of standard versus actual cost variances in the production sector.

- Demonstrate an understanding of the role of standard costing in inventory valuation and its impact on income statements.

Verified Answer

FV

flower vagueMay 01, 2024

Final Answer :  An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.

An unfavorable total variance has the effect of increasing Cost of Goods Sold. A favorable variance has the effect of decreasing Cost of Goods Sold.

Learning Objectives

- Review the economic ramifications of standard versus actual cost variances in the production sector.

- Demonstrate an understanding of the role of standard costing in inventory valuation and its impact on income statements.