Asked by Sofiya Hoyda on Jul 03, 2024

Verified

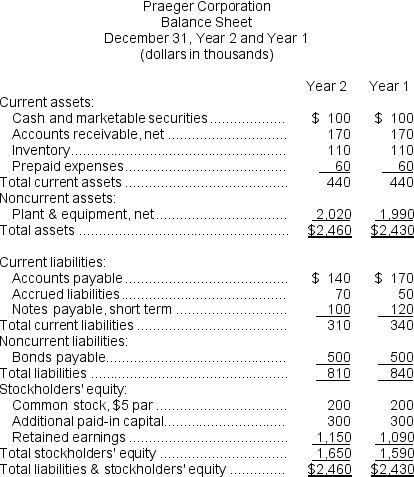

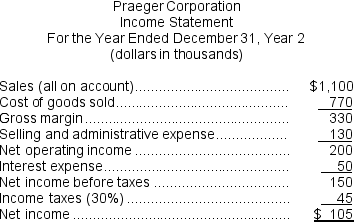

Financial statements for Praeger Corporation appear below:

Dividends during Year 2 totaled $45 thousand.The market price of a share of common stock on December 31, Year 2 was $30.

Dividends during Year 2 totaled $45 thousand.The market price of a share of common stock on December 31, Year 2 was $30.

Required:

Compute the following for Year 2:

a.Return on total assets.

b.Working capital.

c.Current ratio.

d.Acid-test (quick)ratio.

e.Accounts receivable turnover.

f.Average collection period.

g.Inventory turnover.

h.Average sale period.

i.Times interest earned ratio.

j.Debt-to-equity ratio.

Acid-test Ratio

A liquidity ratio that measures a company's ability to pay off its current liabilities with its quick assets (cash, marketable securities, and accounts receivable).

Debt-to-equity Ratio

A financial indicator showing how much of a company's assets are financed by debt compared to shareholders' equity.

Receivable Turnover

A financial ratio that measures how efficiently a company collects its outstanding credit sales, typically calculated annually.

- Calculate and understand various financial ratios and their importance.

- Analyze a company's liquidity position using working capital, current ratio, and acid-test (quick) ratio.

- Evaluate a company's efficiency through accounts receivable turnover, inventory turnover, and the operating cycle.

Verified Answer

= $140 ÷ $2,445 = 5.73%

*Adjusted net income = Net income + [Interest expense × (1 - Tax rate)]

= $105 + [$50 × (1 - 0.30)] = $140

**Average total assets = ($2,460 + $2,430)÷ 2 = $2,445

b.Working capital = Current assets - Current liabilities

= $440 - $310 = $130

c.Current ratio = Current assets ÷ Current liabilities

= $440 ÷ $310 = 1.42

d.Acid-test ratio = Quick assets* ÷ Current liabilities

= $270 ÷ $310 = 0.87

*Quick assets = Cash + Marketable securities + Accounts receivable + Short-term notes receivable

= $100 + $170 = $270

e.Accounts receivable turnover = Sales on account ÷ Average accounts receivable*

= $1,100 ÷ $170 = 6.47

*Average accounts receivable = ($170 + $170)÷ 2 = $170

f.Average collection period = 365 days ÷ Accounts receivable turnover*

= 365 ÷ 6.47 = 56.4 days

*See above

g.Inventory turnover = Cost of goods sold ÷ Average inventory balance*

= $770 ÷ $110 = 7.00

*Average inventory balance = ($110 + $110)÷ 2 = $110

h.Average sale period = 365 days ÷ Inventory turnover*

= 365 ÷7.00 = 52.1 days

*See above

i.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $200 ÷ $50 = 4.00

j.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $810 ÷ $1,650 = 0.49

Learning Objectives

- Calculate and understand various financial ratios and their importance.

- Analyze a company's liquidity position using working capital, current ratio, and acid-test (quick) ratio.

- Evaluate a company's efficiency through accounts receivable turnover, inventory turnover, and the operating cycle.

Related questions

Neiger Corporation Has Provided the Following Financial Data ...

Steinkraus Corporation Has Provided the Following Data: Required ...

Gremel Corporation Has Provided the Following Financial Data: Required ...

Data from Yochem Corporation's Most Recent Balance Sheet Appear Below ...

Kisselburg Corporation Has Provided the Following Financial Data ...