Asked by sauli Lianga on Jun 03, 2024

Verified

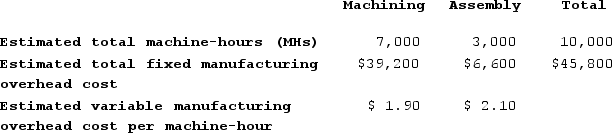

Morataya Corporation has two manufacturing departments--Machining and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job G. There were no beginning inventories. Data concerning those two jobs follow:

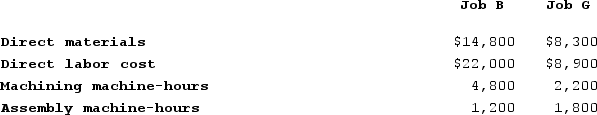

During the most recent month, the company started and completed two jobs--Job B and Job G. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $31,392

B) $27,480

C) $39,240

D) $7,848

Plantwide Predetermined Rate

A single overhead rate calculated by dividing total estimated manufacturing overhead costs by the total estimated amount of the allocation base, applied throughout an entire plant or facility.

Machine-Hours

The total number of hours that machinery is in operation, used as a basis for allocating manufacturing overhead costs in a production environment.

- Implement the application of overhead charges to jobs by using previously set overhead rates.

- Fathom the variances between departmental and plantwide overhead rates.

Verified Answer

Predetermined overhead rate = Total estimated manufacturing overhead cost / Total estimated machine-hours

Predetermined overhead rate = ($246,400 + $72,800) / (8,000 + 5,200)

Predetermined overhead rate = $319,200 / 13,200

Predetermined overhead rate = $24.24 per machine-hour

Next, we need to calculate the amount of manufacturing overhead applied to each job using the predetermined overhead rate and the actual machine-hours used for each job.

For Job B:

Manufacturing overhead applied = Predetermined overhead rate x Actual machine-hours used

Manufacturing overhead applied = $24.24 x 1,320

Manufacturing overhead applied = $31,996.80

Therefore, the closest answer is A) $31,392.

For Job G:

Manufacturing overhead applied = Predetermined overhead rate x Actual machine-hours used

Manufacturing overhead applied = $24.24 x 800

Manufacturing overhead applied = $19,392

The total manufacturing overhead applied to both jobs is:

Total manufacturing overhead applied = $31,996.80 + $19,392

Total manufacturing overhead applied = $51,388.80

Therefore, the amount of manufacturing overhead applied to Job B is closest to $31,392, and the best choice is C) $39,240 as this is the closest given option to the actual amount applied.

Learning Objectives

- Implement the application of overhead charges to jobs by using previously set overhead rates.

- Fathom the variances between departmental and plantwide overhead rates.

Related questions

Mahon Corporation Has Two Production Departments, Casting and Customizing ...

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Carcana Corporation Has Two Manufacturing Departments--Machining and Finishing ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...