Asked by Chhor Sotheanea on May 28, 2024

Verified

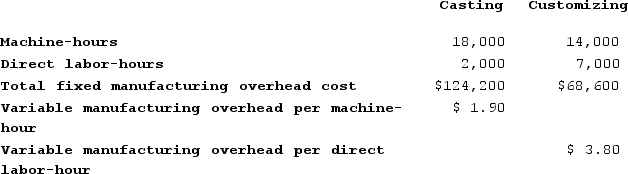

Mahon Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T138. The following data were recorded for this job:

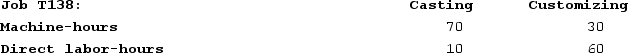

During the current month the company started and finished Job T138. The following data were recorded for this job:

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job T138 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $588.00

B) $95,200.00

C) $816.00

D) $228.00

Predetermined Overhead Rate

An estimated charge used to apply manufacturing overhead to individual products or job orders, calculated in advance of the period.

Machine-Hours

A measure of the total run time that a machine is utilized for production over a specific period, often used as a basis for allocating overhead costs.

Direct Labor-Hours

A measure of the total hours worked by employees who are directly involved in the manufacturing process or production of goods.

- Apply pre-determined overhead rates for the distribution of overhead costs among jobs.

- Evaluate the overhead expenses allocated to a job in a designated department.

Verified Answer

The job used 20 direct labor-hours in the Customizing Department, so the amount of overhead applied would be:

Predetermined overhead rate x Actual direct labor-hours used

$16.00 per DLH x 20 DLH = $320.00

Therefore, the correct answer is C) $816.00, which is the total amount of overhead applied to Job T138 after adding the amounts from both departments:

Casting Department: $496.00

Customizing Department: $320.00

Total Overhead Applied: $496.00 + $320.00 = $816.00.

Learning Objectives

- Apply pre-determined overhead rates for the distribution of overhead costs among jobs.

- Evaluate the overhead expenses allocated to a job in a designated department.

Related questions

Morataya Corporation Has Two Manufacturing Departments--Machining and Assembly ...

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

When the Predetermined Overhead Rate Is Based on Direct Labour-Hours ...