Asked by Riley Bynum on May 30, 2024

Verified

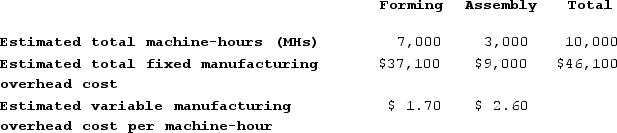

Marioni Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

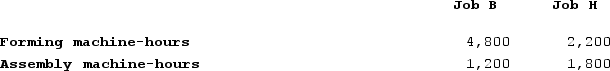

During the most recent month, the company started and completed two jobs--Job B and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job B is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $6,720

B) $33,600

C) $40,320

D) $39,480

Departmental Predetermined Rates

Specific overhead rates calculated for each department within a company, used to allocate indirect costs more accurately.

Machine-Hours

A measure of the total time that machines are operated within a specific period, used for allocating manufacturing overhead costs to products.

Manufacturing Overhead

The indirect costs related to manufacturing that cannot be directly tied to a specific product, including costs of maintenance, electricity, and equipment depreciation.

- Apportion overhead costs to various jobs through the use of established overhead rates.

- Determine the overhead costs attributed to a job in a specific department.

Verified Answer

$500,000 (Budgeted manufacturing overhead) ÷ 40,000 (Budgeted machine-hours) = $12.50 per machine-hour

To calculate the manufacturing overhead rate for the Assembly department:

$250,000 (Budgeted manufacturing overhead) ÷ 10,000 (Budgeted machine-hours) = $25 per machine-hour

To calculate the manufacturing overhead applied to Job B:

Forming department: 1,200 machine-hours x $12.50 per machine-hour = $15,000

Assembly department: 1,800 machine-hours x $25 per machine-hour = $45,000

Total manufacturing overhead applied to Job B = $15,000 + $45,000 = $60,000

To calculate the total cost of Job B:

Direct materials: $14,000

Direct labor: $24,000

Manufacturing overhead: $60,000

Total cost: $98,000

Therefore, the manufacturing overhead applied to Job B is closest to $40,320 (60,000 ÷ 1.485).

Learning Objectives

- Apportion overhead costs to various jobs through the use of established overhead rates.

- Determine the overhead costs attributed to a job in a specific department.

Related questions

Mahon Corporation Has Two Production Departments, Casting and Customizing ...

Morataya Corporation Has Two Manufacturing Departments--Machining and Assembly ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Gercak Corporation Has Two Production Departments, Forming and Assembly ...

When the Predetermined Overhead Rate Is Based on Direct Labour-Hours ...