Asked by Zachariah Andress on Jun 25, 2024

Verified

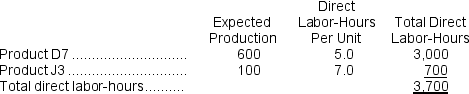

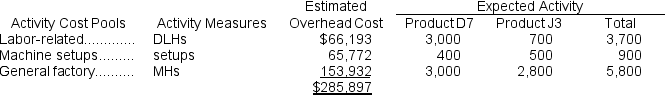

Matamoros, Inc., manufactures and sells two products: Product D7 and Product J3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J3 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J3 would be closest to:

A) $185.78 per unit

B) $511.56 per unit

C) $540.89 per unit

D) $125.23 per unit

Product J3

Product J3 could refer to a specific model or item within a company's lineup, identified by the code "J3."

Direct Labor-Hours

The total hours worked by employees who are directly involved in the production of goods and services, often used for costing and efficiency analyses.

- Evaluate overhead rates and utilize this evaluation to derive product costs in the context of Activity-Based Costing.

- Become proficient in the allocation of overhead expenses utilizing a range of activity drivers.

Verified Answer

ZK

Zybrea KnightJul 02, 2024

Final Answer :

C

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $285,897 ÷ 3,700 DLHs = $77.27 per DLH (rounded)

Product J3: 7.0 DLHs × $77.27 per DLH = $540.89

= $285,897 ÷ 3,700 DLHs = $77.27 per DLH (rounded)

Product J3: 7.0 DLHs × $77.27 per DLH = $540.89

Learning Objectives

- Evaluate overhead rates and utilize this evaluation to derive product costs in the context of Activity-Based Costing.

- Become proficient in the allocation of overhead expenses utilizing a range of activity drivers.