Asked by Frank Milosevics on Apr 25, 2024

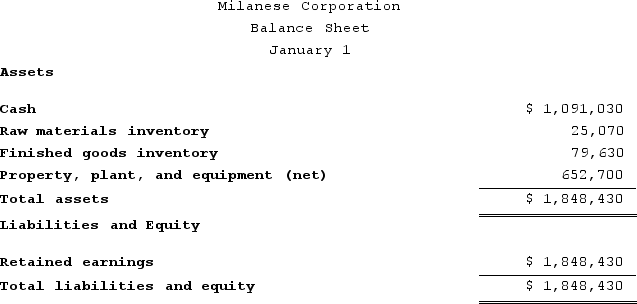

Milanese Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

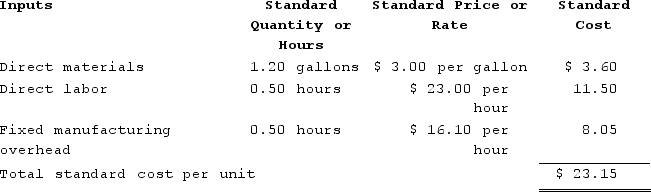

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $161,000 and budgeted activity of 10,000 hours.

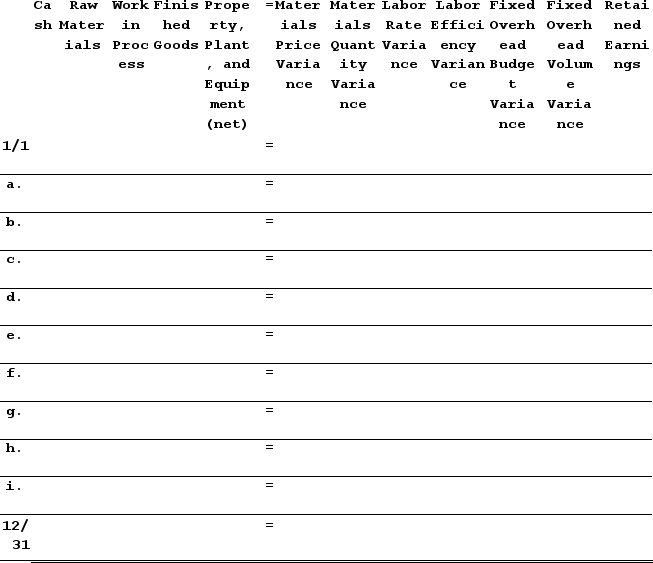

During the year, the company completed the following transactions:Purchased 24,400 gallons of raw material at a price of $3.90 per gallon.Used 21,460 gallons of the raw material to produce 17,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,300 hours at an average cost of $23.40 per hour.Applied fixed overhead to the 17,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $170,800. Of this total, $122,790 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $48,010 related to depreciation of manufacturing equipment.Transferred 17,800 units from work in process to finished goods.Sold for cash 17,700 units to customers at a price of $46.60 per unit.Completed and transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.Paid $53,390 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below.

3. Determine the ending balance (e.g., 12/31 balance) in each account.

3. Determine the ending balance (e.g., 12/31 balance) in each account.

Direct Labor

The labor costs directly traceable to the production of goods or services, such as wages paid to workers or machine operators.

Fixed Overhead

Overhead expenses that remain constant regardless of a company's level of production or sales.

Raw Material

Basic materials used in the production process that are transformed into finished goods through manufacturing.

- Become skilled at precisely documenting transactions in a standard costing system.

- Adopt the proficiency to pinpoint the divergences between anticipated costs and actual spending, specifically for direct materials, direct labor, and fixed overhead variances.

- Absorb the methodology for reallocating standard cost variances to Cost of Goods Sold.

Learning Objectives

- Become skilled at precisely documenting transactions in a standard costing system.

- Adopt the proficiency to pinpoint the divergences between anticipated costs and actual spending, specifically for direct materials, direct labor, and fixed overhead variances.

- Absorb the methodology for reallocating standard cost variances to Cost of Goods Sold.