Asked by Oguche Agnebb on Jun 16, 2024

Verified

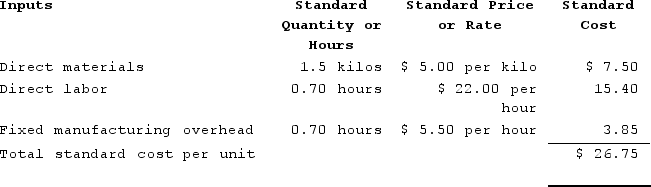

Lusher Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

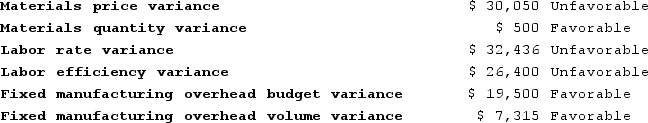

The company calculated the following variances for the year:

The company calculated the following variances for the year:

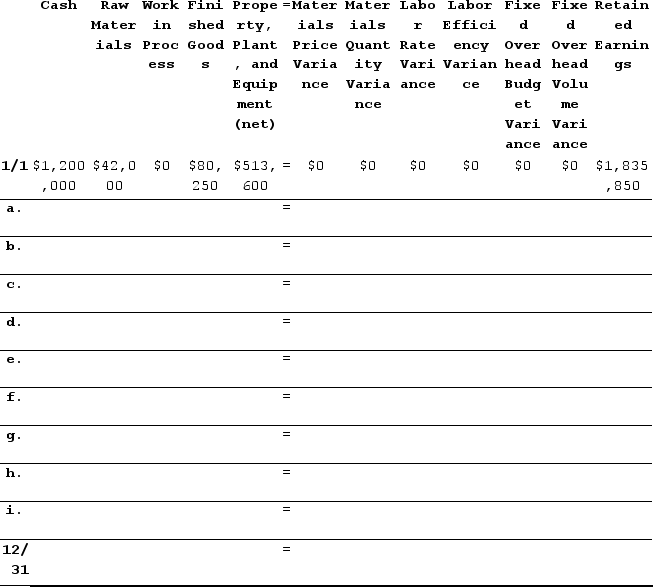

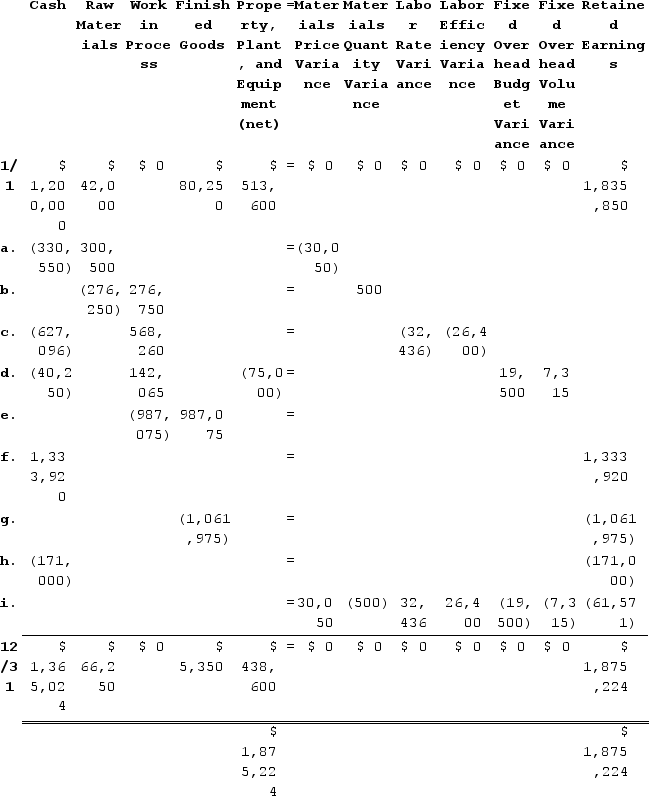

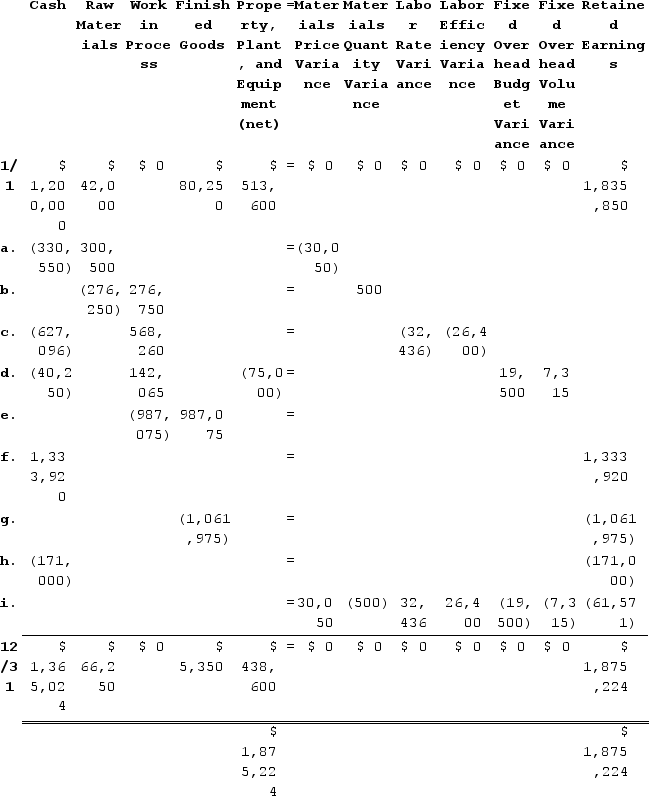

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.During the year, the company completed the following transactions:Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 27,030 hours at an average cost of $23.20 per hour.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $115,250. Of this total, $40,250 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.Transferred 36,900 units from work in process to finished goods.Sold for cash 39,700 units to customers at a price of $33.60 per unit.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.Paid $171,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

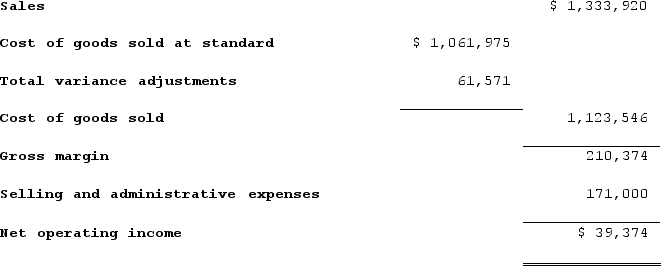

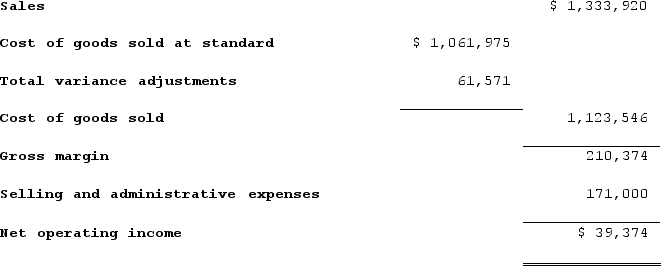

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2. Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

Fixed Overhead

The portion of overhead costs that remains constant regardless of the level of production or business activity.

Direct Labor

The labor costs directly tied to the production of goods or services, such as wages paid to employees who physically produce a product.

Raw Material

Fundamental components and elements employed at the beginning of the manufacturing or production process.

- Master the technique of precise transaction recording in a standard costing system.

- Attain the capacity to identify disparities between actual and standard costs, specifically in direct materials, direct labor, and fixed overhead variances.

- Comprehend the methodology for preparing and analyzing income statements within manufacturing entities utilizing standard costing.

Verified Answer

GJ

Gloria JamesJun 17, 2024

Final Answer :

1. and 2.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Actual price = 60,100 kilos × $5.50 per kilo = $330,550. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 60,100 kilos × $5.00 per kilo = $300,500. The materials price variance is $30,050 Unfavorable.Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 55,250 kilos × $5.00 per kilo = $276,250. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (36,900 units ×1.5 kilos per unit) × $5.00 per kilo = 55,350 kilos × $5.00 per kilo = $276,750. The difference is the Materials Quantity Variance which is $500 Favorable.Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 27,030 hours × $23.20 per hour = $627,096. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (36,900 units × 0.70 hours per unit) × $22.00 per hour = 25,830 hours × $22.00 per hour = $568,260. The difference consists of the Labor Rate Variance which is $32,436 Unfavorable and the Labor Efficiency Variance which is $26,400 Unfavorable.Cash decreases by the actual amount paid for various fixed overhead costs, which is $40,250. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (36,900 units × 0.70 hours per unit) × $5.50 per hour = 25,830 hours × $5.50 per hour = $142,065. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $75,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $19,500 Favorable and the Fixed Overhead (FOH) Volume Variance which is $7,315 Favorable.Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 36,900 units × $26.75 per unit = $987,075. Finished Goods increases by the same amount.Cash increases by the number of units sold multiplied by the selling price per unit, which is 39,700 units × $33.6 per unit = $1,333,920. Retained Earnings increases by the same amount.Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 39,700 units × $26.75 per unit = $1,061,975. Retained Earnings decreases by the same amount.Cash and Retained Earnings decrease by $171,000 to record the selling and administrative expenses.All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

Learning Objectives

- Master the technique of precise transaction recording in a standard costing system.

- Attain the capacity to identify disparities between actual and standard costs, specifically in direct materials, direct labor, and fixed overhead variances.

- Comprehend the methodology for preparing and analyzing income statements within manufacturing entities utilizing standard costing.