Asked by MARIO MURILLO on May 08, 2024

Verified

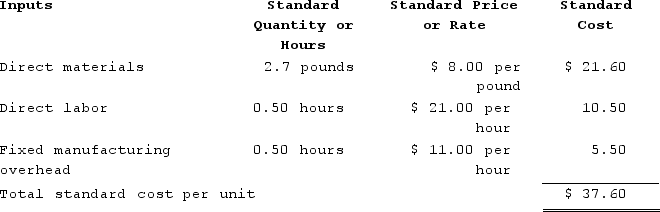

Ferrini Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $82,500 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $82,500 and budgeted activity of 7,500 hours.

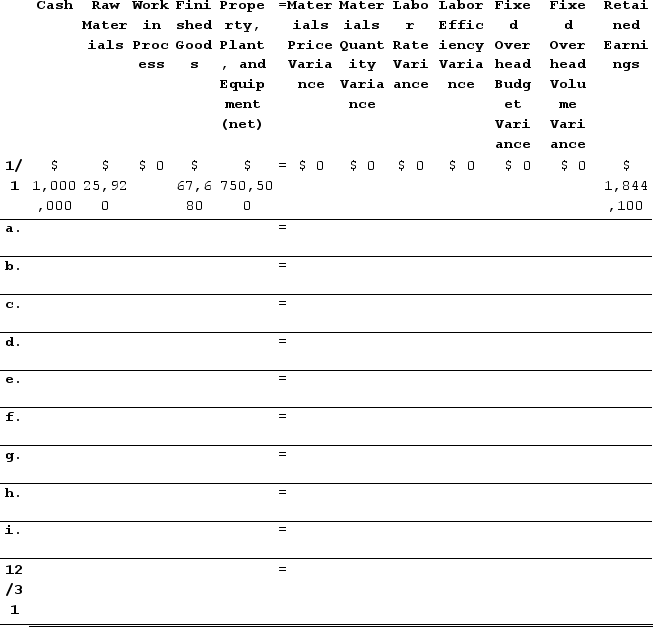

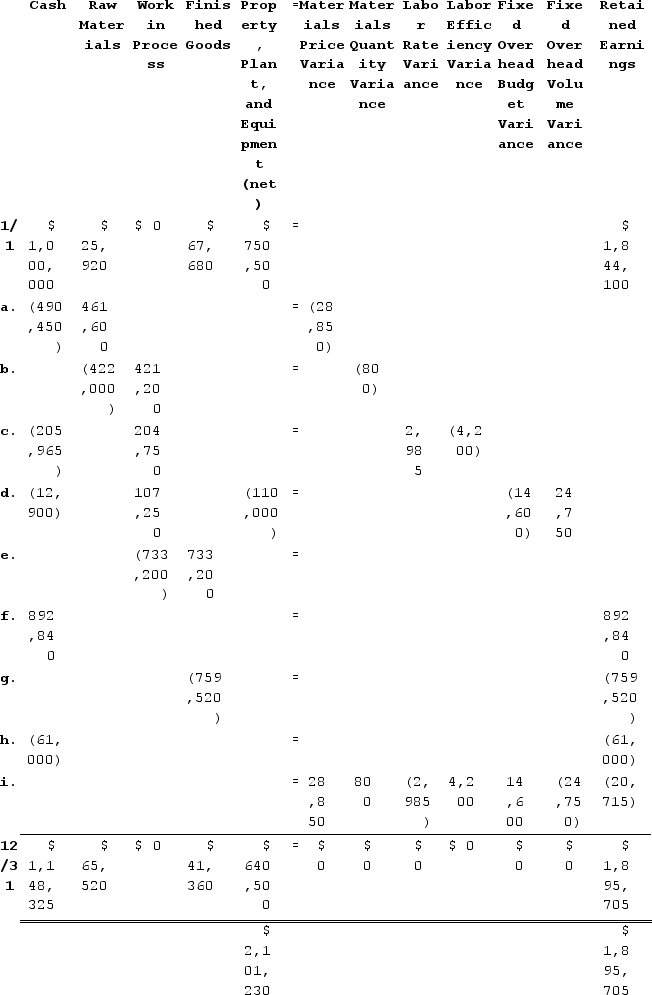

During the year, the company completed the following transactions:a. Purchased 57,700 pounds of raw material at a price of $8.50 per pound.b. Used 52,750 pounds of the raw material to produce 19,500 units of work in process.c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 9,950 hours at an average cost of $20.70 per hour.d. Applied fixed overhead to the 19,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $97,100. Of this total, -$12,900 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $110,000 related to depreciation of manufacturing equipment.e. Transferred 19,500 units from work in process to finished goods.f. Sold for cash 20,200 units to customers at a price of $44.20 per unit.g. Completed and transferred the standard cost associated with the 20,200 units sold from finished goods to cost of goods sold.h. Paid $61,000 of selling and administrative expenses.i. Closed all standard cost variances to cost of goods sold.

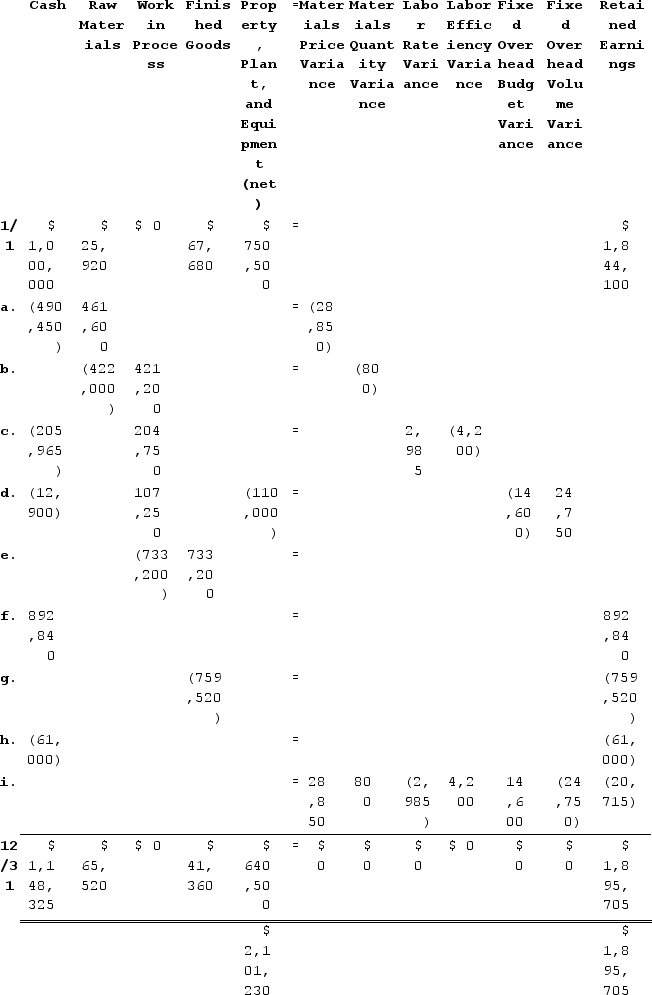

Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Record the above transactions in the worksheet that appears below. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

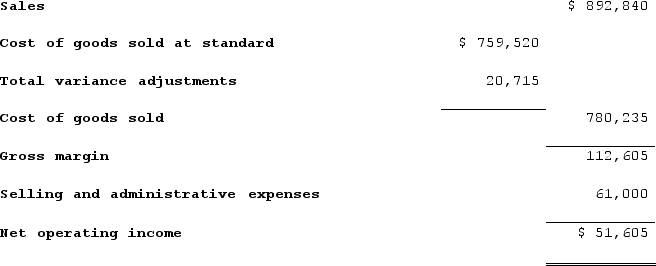

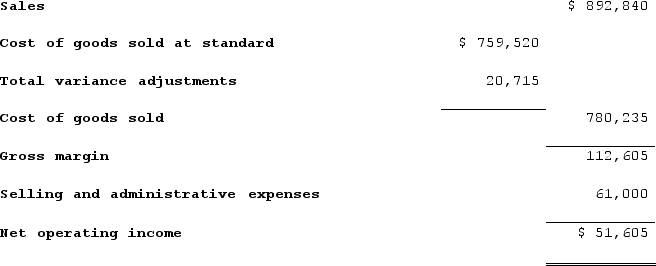

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

Direct Labor Costs

Compensation and perks given to workers directly engaged in creating products or services.

Fixed Overhead

Regular, unchanged costs associated with operating a business, such as rent and salaries, irrespective of production levels.

Work in Process

Goods that are in various stages of completion in the manufacturing process but are not yet finished products.

- Gain expertise in the accurate documentation of transactions in a standard costing system.

- Obtain the ability to assess variances between projected costs and actual spending, including in areas of direct materials, direct labor, and fixed overhead.

- Acquire knowledge on the generation and examination of income statements for manufacturing organizations employing standard costing methods.

Verified Answer

JO

janeth ornelasMay 12, 2024

Final Answer :

1. Materials price variance = Actual quantity × (Average price − Standard price)= 57,700 pounds × ($8.50 per pound − $8.00 per pound)= 57,700 pounds × ($0.50 per pound)= $28,850 UnfavorableMaterials quantity variance:Standard quantity = Actual output × Standard quantity = 19,500 units × 2.7 pounds per unit = 52,650 poundsMaterials quantity variance = (Actual quantity − Standard quantity) × Standard price= (52,750 pounds − 52,650 pounds) × $8.00 per pound= (100 pounds) × $8.00 per pound= $800 UnfavorableLabor rate variance = Actual hours × (Actual rate − Standard rate)= 9,950 hours × ($20.70 per hour − $21.00 per hour)= 9,950 hours × (-$0.30 per hour)= $2,985 FavorableLabor efficiency variance:Standard hours = Actual output × Standard quantity = 19,500 units × 0.50 hours per unit = 9,750 hoursLabor efficiency variance = (Actual hours − Standard hours) × Standard rate= (9,950 hours − 9,750 hours) × $21.00 per hour= (200 hours) × $21.00 per hour= $4,200 UnfavorableBudget variance = Actual fixed overhead − Budgeted fixed overhead= $97,100 − $82,500= $14,600 UnfavorableVolume variance = Budgeted fixed overhead − Fixed overhead applied to work in process= $82,500 − (9,750 hours × $11.00 per hour)= $82,500 − ($107,250)= $24,750 Favorable2. & 3.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 57,700 pounds × $8.50 per pound = $490,450. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 57,700 pounds × $8.00 per pound = $461,600. The materials price variance is $28,850 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 52,750 pounds × $8.00 per pound = $422,000. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (19,500 units × 2.7 pounds per unit) × $8.00 per pound = 52,650 pounds × $8.00 per pound = $421,200. The difference is the Materials Quantity Variance which is $800 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 9,950 hours × $20.70 per hour = $205,965. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (19,500 units × 0.50 hours per unit) × $21.00 per hour = 9,750 hours × $21.00 per hour = $204,750. The difference consists of the Labor Rate Variance which is $2,985 Favorable and the Labor Efficiency Variance which is $4,200 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is -$12,900. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (19,500 units × 0.50 hours per unit) × $11.00 per hour = 9,750 hours × $11.00 per hour = $107,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $110,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $14,600 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $24,750 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 19,500 units × $37.60 per unit = $733,200. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 20,200 units × $44.20 per unit = $892,840. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 20,200 units × $37.60 per unit = $759,520. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $61,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 57,700 pounds × $8.50 per pound = $490,450. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 57,700 pounds × $8.00 per pound = $461,600. The materials price variance is $28,850 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 52,750 pounds × $8.00 per pound = $422,000. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (19,500 units × 2.7 pounds per unit) × $8.00 per pound = 52,650 pounds × $8.00 per pound = $421,200. The difference is the Materials Quantity Variance which is $800 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 9,950 hours × $20.70 per hour = $205,965. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (19,500 units × 0.50 hours per unit) × $21.00 per hour = 9,750 hours × $21.00 per hour = $204,750. The difference consists of the Labor Rate Variance which is $2,985 Favorable and the Labor Efficiency Variance which is $4,200 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is -$12,900. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (19,500 units × 0.50 hours per unit) × $11.00 per hour = 9,750 hours × $11.00 per hour = $107,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $110,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $14,600 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $24,750 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 19,500 units × $37.60 per unit = $733,200. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 20,200 units × $44.20 per unit = $892,840. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 20,200 units × $37.60 per unit = $759,520. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $61,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

4.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 57,700 pounds × $8.50 per pound = $490,450. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 57,700 pounds × $8.00 per pound = $461,600. The materials price variance is $28,850 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 52,750 pounds × $8.00 per pound = $422,000. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (19,500 units × 2.7 pounds per unit) × $8.00 per pound = 52,650 pounds × $8.00 per pound = $421,200. The difference is the Materials Quantity Variance which is $800 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 9,950 hours × $20.70 per hour = $205,965. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (19,500 units × 0.50 hours per unit) × $21.00 per hour = 9,750 hours × $21.00 per hour = $204,750. The difference consists of the Labor Rate Variance which is $2,985 Favorable and the Labor Efficiency Variance which is $4,200 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is -$12,900. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (19,500 units × 0.50 hours per unit) × $11.00 per hour = 9,750 hours × $11.00 per hour = $107,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $110,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $14,600 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $24,750 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 19,500 units × $37.60 per unit = $733,200. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 20,200 units × $44.20 per unit = $892,840. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 20,200 units × $37.60 per unit = $759,520. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $61,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 57,700 pounds × $8.50 per pound = $490,450. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 57,700 pounds × $8.00 per pound = $461,600. The materials price variance is $28,850 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 52,750 pounds × $8.00 per pound = $422,000. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (19,500 units × 2.7 pounds per unit) × $8.00 per pound = 52,650 pounds × $8.00 per pound = $421,200. The difference is the Materials Quantity Variance which is $800 Unfavorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 9,950 hours × $20.70 per hour = $205,965. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (19,500 units × 0.50 hours per unit) × $21.00 per hour = 9,750 hours × $21.00 per hour = $204,750. The difference consists of the Labor Rate Variance which is $2,985 Favorable and the Labor Efficiency Variance which is $4,200 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is -$12,900. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (19,500 units × 0.50 hours per unit) × $11.00 per hour = 9,750 hours × $11.00 per hour = $107,250. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $110,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $14,600 Unfavorable and the Fixed Overhead (FOH) Volume Variance which is $24,750 Favorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 19,500 units × $37.60 per unit = $733,200. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 20,200 units × $44.20 per unit = $892,840. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 20,200 units × $37.60 per unit = $759,520. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $61,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).4.

Learning Objectives

- Gain expertise in the accurate documentation of transactions in a standard costing system.

- Obtain the ability to assess variances between projected costs and actual spending, including in areas of direct materials, direct labor, and fixed overhead.

- Acquire knowledge on the generation and examination of income statements for manufacturing organizations employing standard costing methods.