Asked by Banaz Fetah on Jul 03, 2024

Verified

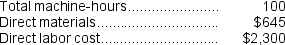

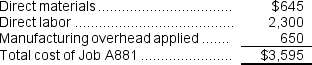

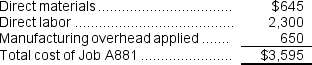

Placker Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $155,000, variable manufacturing overhead of $3.40 per machine-hour, and 50,000 machine-hours.Recently, Job A881 was completed with the following characteristics:  The total job cost for Job A881 is closest to:

The total job cost for Job A881 is closest to:

A) $3,595

B) $2,945

C) $2,950

D) $1,295

Plantwide Predetermined Overhead

An overhead rate calculated for an entire manufacturing plant, applied to all products regardless of the specific department in which they were produced.

Machine-Hours

A measure of production activity that quantifies the number of hours machines are operated in the manufacturing process.

- Determine the complete financial expenditure of a job, taking into account the costs of direct materials, direct labor, and applied overhead expenses.

Verified Answer

BA

Bright AsareJul 09, 2024

Final Answer :

A

Explanation :

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $155,000 + ($3.40 per machine-hour × 50,000 machine-hours)= $155,000 + $170,000 = $325,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $325,000 ÷ 50,000 machine-hours = $6.50 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $6.50 per machine-hour × 100 machine-hours = $650

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $325,000 ÷ 50,000 machine-hours = $6.50 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $6.50 per machine-hour × 100 machine-hours = $650

Learning Objectives

- Determine the complete financial expenditure of a job, taking into account the costs of direct materials, direct labor, and applied overhead expenses.

Related questions

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Grib Corporation Uses a Predetermined Overhead Rate Based on Direct ...

The Job Cost Sheet for Job Number 83-421 Includes the ...

Copy Center Pays an Average Wage of $12 Per Hour ...