Asked by Audrey Craft on May 29, 2024

Verified

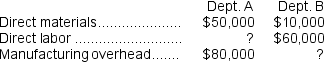

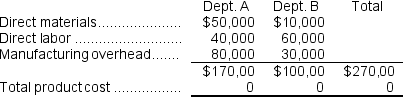

Grib Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs.The predetermined overhead rates for the year are 200% of direct labor cost for Department A and 50% of direct labor cost for Department B.Job 436, started and completed during the year, was charged with the following costs:  The total manufacturing cost assigned to Job 436 was:

The total manufacturing cost assigned to Job 436 was:

A) $360,000

B) $390,000

C) $270,000

D) $480,000

Predetermined Overhead Rates

Rates used to allocate manufacturing overhead costs to products, typically based on estimated costs and activity levels at the beginning of a period.

Direct Labor Cost

The total cost associated with employing workers who directly manufacture products or perform services, including wages and other benefits.

- Compute the aggregate cost of a job, including expenses related to direct materials, direct labor, and allocated overhead.

Verified Answer

CB

Christiaan BurgosJun 02, 2024

Final Answer :

C

Explanation :

To calculate the manufacturing overhead applied to Job 436, we need to determine the direct labor cost for each department.

For Department A:

Direct Labor Cost = $120,000

Manufacturing Overhead Applied = 200% * $120,000 = $240,000

For Department B:

Direct Labor Cost = $90,000

Manufacturing Overhead Applied = 50% * $90,000 = $45,000

Total Manufacturing Overhead Applied = $240,000 + $45,000 = $285,000

Therefore, the total manufacturing cost assigned to Job 436 is:

Direct Materials + Direct Labor + Manufacturing Overhead Applied

= $60,000 + $210,000 + $285,000

= $555,000

Therefore, the correct answer is C) $270,000.

For Department A:

Direct Labor Cost = $120,000

Manufacturing Overhead Applied = 200% * $120,000 = $240,000

For Department B:

Direct Labor Cost = $90,000

Manufacturing Overhead Applied = 50% * $90,000 = $45,000

Total Manufacturing Overhead Applied = $240,000 + $45,000 = $285,000

Therefore, the total manufacturing cost assigned to Job 436 is:

Direct Materials + Direct Labor + Manufacturing Overhead Applied

= $60,000 + $210,000 + $285,000

= $555,000

Therefore, the correct answer is C) $270,000.

Explanation :

Department A manufacturing overhead = Predetermined overhead rate × Amount of the allocation base incurred

$80,000 = 200% x Direct labor

Direct labor = $40,000

Department B manufacturing overhead = Predetermined overhead rate × Amount of the allocation base incurred = 50% x $60,000 = $30,000

$80,000 = 200% x Direct labor

Direct labor = $40,000

Department B manufacturing overhead = Predetermined overhead rate × Amount of the allocation base incurred = 50% x $60,000 = $30,000

Learning Objectives

- Compute the aggregate cost of a job, including expenses related to direct materials, direct labor, and allocated overhead.

Related questions

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Placker Corporation Uses a Job-Order Costing System with a Single ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

The Job Cost Sheet for Job Number 83-421 Includes the ...

Copy Center Pays an Average Wage of $12 Per Hour ...