Asked by Ericka Eldridge on Apr 29, 2024

Verified

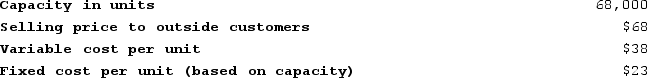

Manni Products, Incorporated, has a Pump Division that manufactures and sells a number of products, including a standard pump. Data concerning that pump appear below:

The company has a Pool Products Division that needs 7,000 special heavy-duty pumps per year. The Pump Division's variable cost to manufacture and ship this special pump would be $43 per unit. Making these special pumps would require more manufacturing resources. Therefore, the Pump Division would have to reduce its production and sales of regular pumps to outside customers from 68,000 units per year to 56,100 units per year.

The company has a Pool Products Division that needs 7,000 special heavy-duty pumps per year. The Pump Division's variable cost to manufacture and ship this special pump would be $43 per unit. Making these special pumps would require more manufacturing resources. Therefore, the Pump Division would have to reduce its production and sales of regular pumps to outside customers from 68,000 units per year to 56,100 units per year.

Required:

As far as the Pump Division is concerned, what is the lowest acceptable transfer price for the special pumps?

Transfer Price

The price charged for goods or services sold between departments or subsidiaries within the same company.

Pump Division

A segment within a company that specializes in the production, sale, and maintenance of pump equipment.

Pool Products Division

A specific division within a company that focuses on the development, production, and sales of products related to swimming pools, such as pool chemicals, filters, and equipment.

- Acquire insight into and communicate the fundamentals of transfer pricing and the acceptable pricing spectrum in a corporate context.

- Examine the impact of production capacity constraints on the decision-making process for production and pricing in a business environment.

Verified Answer

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

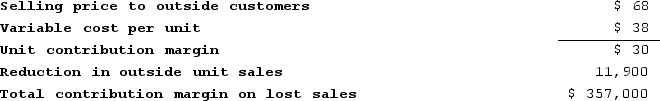

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $43.00 per unit + ($357,000 ÷ 7,000 units) = $43.00 per unit + $51.00 per unit = $94.00 per unit

Learning Objectives

- Acquire insight into and communicate the fundamentals of transfer pricing and the acceptable pricing spectrum in a corporate context.

- Examine the impact of production capacity constraints on the decision-making process for production and pricing in a business environment.

Related questions

Gauani Products, Incorporated, Has a Detector Division That Manufactures and ...

Cominsky Products, Incorporated, Has a Screen Division That Manufactures and ...

Chesley Products, Incorporated, Has a Connector Division That Manufactures and ...

Trendell Products, Incorporated, Has a Motor Division That Manufactures and ...

Ulrich Company Has a Castings Division Which Does Casting Work ...