Asked by Deledai Johnson on May 22, 2024

Verified

Ulrich Company has a Castings Division which does casting work of various types. The company's Machine Products Division has asked the Castings Division to provide it with 20,000 special castings each year on a continuing basis. The special casting would require $12 per unit in variable production costs.In order to have time and space to produce the new casting, the Castings Division would have to cut back production of another casting - the RB4 which it presently is producing. The RB4 sells for $40 per unit, and requires $18 per unit in variable production costs. Boxing and shipping costs of the RB4 are $6 per unit. Boxing and shipping costs for the new special casting would be only $1 per unit, thereby saving the company $5 per unit in cost. The company is now producing and selling 100,000 units of the RB4 each year. Production and sales of this casting would drop by 25 percent if the new casting is produced. Some $240,000 in fixed production costs in the Castings Division are now being covered by the RB4 casting; 25 percent of these costs would have to be covered by the new casting if it is produced and sold to the Machine Products Division.

Required:

According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division? Show all computations.

Transfer Price

The cost at which products or services are exchanged between departments or divisions within the same organization.

Castings Division

A specialized department within a manufacturing company focused on producing parts by pouring molten material into molds.

Machine Products Division

A specialized department or section within a company focused on the manufacturing and distribution of machine-based products.

- Absorb and convey the concepts related to transfer pricing and the allowable price margins within a corporate setting.

- Investigate the repercussions of restricted capacity on corporate production choices and price determination.

Verified Answer

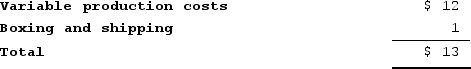

Variable costs:

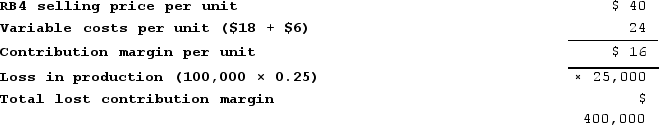

Lost contribution margin on outside sales:

Lost contribution margin on outside sales: $400,000 ÷ 20,000 new castings = $20 per casting.

$400,000 ÷ 20,000 new castings = $20 per casting.Therefore, the lower limit on the transfer price should be:

Transfer price = $13 + $20 = $33 per casting.

Learning Objectives

- Absorb and convey the concepts related to transfer pricing and the allowable price margins within a corporate setting.

- Investigate the repercussions of restricted capacity on corporate production choices and price determination.

Related questions

Manni Products, Incorporated, Has a Pump Division That Manufactures and ...

Trendell Products, Incorporated, Has a Motor Division That Manufactures and ...

Chesley Products, Incorporated, Has a Connector Division That Manufactures and ...

Liapis Products, Incorporated, Has a Valve Division That Manufactures and ...

Lank Products, Incorporated, Has a Transmitter Division That Manufactures and ...