Asked by Yasmine Bedjaoui on May 01, 2024

Verified

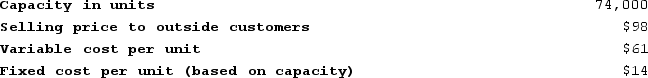

Cominsky Products, Incorporated, has a Screen Division that manufactures and sells a number of products, including a standard screen. Data concerning that screen appear below:

The company has a Home Security Division that could use this screen in one of its products. The Home Security Division is currently purchasing 6,000 of these screens per year from an overseas supplier at a cost of $96 per screen.

The company has a Home Security Division that could use this screen in one of its products. The Home Security Division is currently purchasing 6,000 of these screens per year from an overseas supplier at a cost of $96 per screen.

Required:

Assume that the Screen Division is selling all of the screens it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

Home Security Division

A specialized segment within a company that focuses on products and services related to securing homes from intruders, fire, and other dangers.

- Educate oneself on and express clearly the concepts of transfer pricing and the acceptable price limits within a corporate constituency.

- Delve into the implications of limited production capacity on the formulation of pricing and production strategies within a business.

Verified Answer

JA

Johnny AppleseedMay 02, 2024

Final Answer :

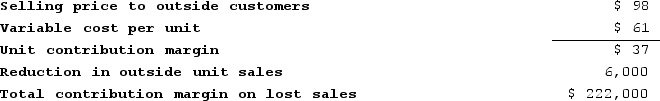

The total contribution margin on lost sales is computed as follows:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $61 per unit + ($222,000 ÷ 6,000 units) = $61 per unit + $37 per unit = $98 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $96 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $61 per unit + ($222,000 ÷ 6,000 units) = $61 per unit + $37 per unit = $98 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $96 per unit

No transfer will be made between the two divisions because the minimum price that the selling division is willing to accept is greater than the maximum price that the buying division is willing to pay.

Learning Objectives

- Educate oneself on and express clearly the concepts of transfer pricing and the acceptable price limits within a corporate constituency.

- Delve into the implications of limited production capacity on the formulation of pricing and production strategies within a business.

Related questions

Gauani Products, Incorporated, Has a Detector Division That Manufactures and ...

Manni Products, Incorporated, Has a Pump Division That Manufactures and ...

Chesley Products, Incorporated, Has a Connector Division That Manufactures and ...

Trendell Products, Incorporated, Has a Motor Division That Manufactures and ...

Ulrich Company Has a Castings Division Which Does Casting Work ...