Asked by suzette martinez on May 03, 2024

Verified

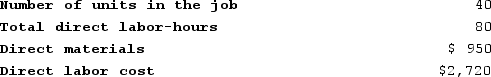

Lueckenhoff Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $497,000, variable manufacturing overhead of $2.40 per direct labor-hour, and 70,000 direct labor-hours. The company has provided the following data concerning Job T498 which was recently completed:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

A) $11.90 per direct labor-hour

B) $7.10 per direct labor-hour

C) $9.50 per direct labor-hour

D) $2.40 per direct labor-hour

Predetermined Overhead Rate

An estimated rate used to assign manufacturing overhead costs to products based on a cost driver, calculated before the period begins.

Variable Manufacturing Overhead

Overhead costs that vary with production volume, including indirect labor and utilities.

Direct Labor-Hours

The total hours of labor time directly involved in producing goods or providing services, often used as a basis for allocating manufacturing overhead.

- Determine and appreciate the value of fixed overhead rates in job-order costing methodologies.

Verified Answer

Total overhead cost = fixed overhead cost + (variable overhead rate x direct labor-hours)

Total overhead cost = $497,000 + ($2.40 x 70,000)

Total overhead cost = $497,000 + $168,000

Total overhead cost = $665,000

Predetermined overhead rate = total overhead cost / direct labor-hours

Predetermined overhead rate = $665,000 / 70,000

Predetermined overhead rate = $9.50 per direct labor-hour

Therefore, the closest predetermined overhead rate is $9.50 per direct labor-hour, which is option C.

Learning Objectives

- Determine and appreciate the value of fixed overhead rates in job-order costing methodologies.

Related questions

Lupo Corporation Uses a Job-Order Costing System with a Single ...

Dancel Corporation Has Two Production Departments, Milling and Finishing ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...

Madole Corporation Has Two Production Departments, Forming and Customizing ...