Asked by Yasmin Garcia on May 27, 2024

Verified

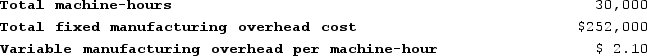

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

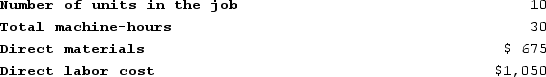

Recently, Job T687 was completed with the following characteristics:

The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

A) $12.60 per machine-hour

B) $10.50 per machine-hour

C) $8.40 per machine-hour

D) $2.10 per machine-hour

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual products or job orders, based on a certain activity base.

Machine-Hours

A measure of production output or activity based on the number of hours machines are operated in the manufacturing process.

Job-Order Costing System

An accounting method used to accumulate and assign costs to custom or unique products or jobs.

- Compute and comprehend the significance of pre-established overhead rates within job-order costing systems.

Verified Answer

Total estimated overhead costs = $420,000 + $140,000 = $560,000

Total estimated machine-hours = 40,000 + 20,000 = 60,000

Predetermined overhead rate = $560,000 / 60,000 machine-hours = $9.33 per machine-hour

Therefore, the closest answer is B) $10.50 per machine-hour.

Learning Objectives

- Compute and comprehend the significance of pre-established overhead rates within job-order costing systems.

Related questions

Lueckenhoff Corporation Uses a Job-Order Costing System with a Single ...

Madole Corporation Has Two Production Departments, Forming and Customizing ...

Vasilopoulos Corporation Has Two Production Departments, Casting and Assembly ...

Mccaughan Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Hultquist Corporation Has Two Manufacturing Departments--Forming and Customizing ...