Asked by Danielle Efrat on Apr 24, 2024

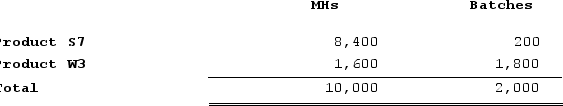

Lakey Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $11,000 for the Machining cost pool, $26,200 for the Setting Up cost pool, and $9,800 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Activity-Based Costing

A costing method that identifies activities in an organization and assigns the cost of each activity with resources to all products and services according to the actual consumption by each.

Activity Cost Pools

Groups of costs segmented based on activities performed, used in activity-based costing to allocate costs more accurately.

Machine-Hours

Machine-hours are a measure of the total time machines are operated during a specific period, typically used for allocating manufacturing overhead costs.

- Gain insight into the basic concepts of Activity-Based Costing (ABC).

- Determine the activity rates for various cost pools in an ABC system.

- Apportion overhead expenditures to products through calculated activity rates.

Learning Objectives

- Gain insight into the basic concepts of Activity-Based Costing (ABC).

- Determine the activity rates for various cost pools in an ABC system.

- Apportion overhead expenditures to products through calculated activity rates.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...