Asked by Ferhat Butun on May 19, 2024

Verified

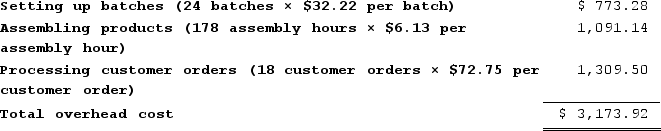

Desjarlais Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.

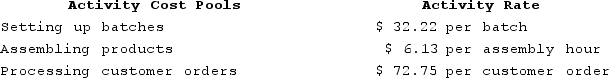

Data concerning two products appear below:

Data concerning two products appear below:

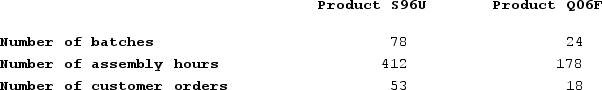

Required:a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system? Show your work!b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system? Show your work!

Required:a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system? Show your work!b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system? Show your work!

Activity Rates

The costs associated with specific activities, used in activity-based costing to allocate overhead costs based on actual consumption.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, improving costing accuracy.

Overhead Cost

Indirect costs of running a business that are not directly tied to a specific product or service, such as rent, utilities, and administrative expenses.

- Become proficient in the principles of Activity-Based Costing (ABC).

- Assign overhead charges to products by leveraging calculated activity rates.

Verified Answer

Learning Objectives

- Become proficient in the principles of Activity-Based Costing (ABC).

- Assign overhead charges to products by leveraging calculated activity rates.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Ciulla Corporation Manufactures Two Products: Product J12N and Product H63J ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

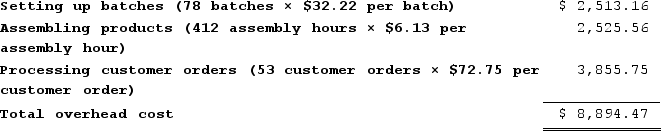

b.Product Q06F

b.Product Q06F