Asked by Carol Hersan on May 19, 2024

Verified

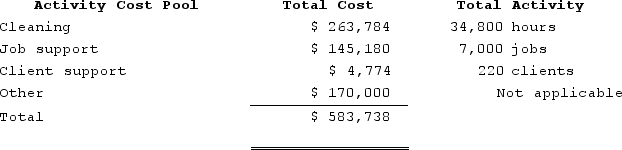

Dane Housecleaning provides housecleaning services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Hoium family, requested 45 jobs during the year that required a total of 90 hours of housecleaning. For this service, the client was charged $2,000.Required:

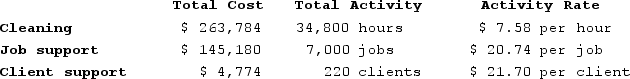

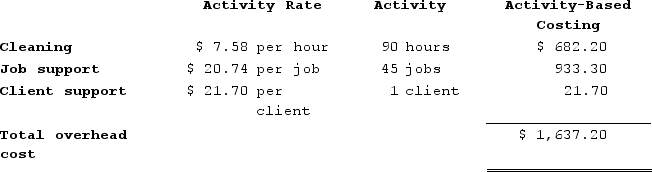

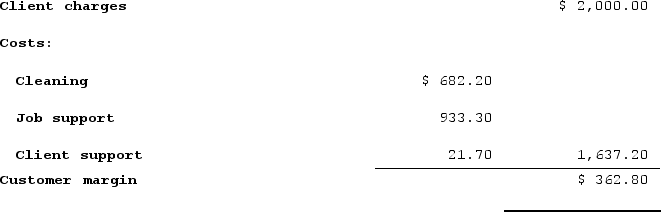

a. Compute the activity rates (i.e., cost per unit of activity) for the activity cost pools. Round off all calculations to the nearest whole cent.b. Using the activity-based costing system, compute the customer margin for the Hoium family. Round off all calculations to the nearest whole cent.c. Assume the company decides instead to use a traditional costing system in which ALL costs are allocated to customers on the basis of cleaning hours. Compute the margin for the Hoium family. (Round off all calculations to the nearest whole cent.)

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing more accurate insights into the true costs of production.

Activity Rates

In activity-based costing, the cost allocation rate for each activity cost pool, allowing for more accurate product or service costing.

Customer Margin

The profit margin that is generated from a specific customer, calculated by subtracting the costs associated with serving that customer from the revenue earned from them.

- Comprehend the fundamentals of Activity-Based Costing (ABC).

- Compute the rates of activities for different cost pools within an Activity-Based Costing system.

- Calculate customer margins utilizing Activity-Based Costing data.

Verified Answer

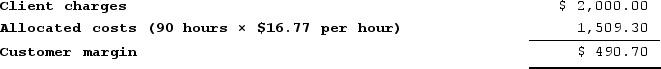

b.The customer margin for the family is computed as follows:

b.The customer margin for the family is computed as follows: The customer margin for the family is computed as follows:

The customer margin for the family is computed as follows: c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

c.The margin if all costs are allocated on the basis of cleaning hours:Predetermined overhead rate = Estimated total overhead cost ÷ Estimated total amount of the allocation base = $583,738 ÷ 34,800 hours= $16.77 per hour

Learning Objectives

- Comprehend the fundamentals of Activity-Based Costing (ABC).

- Compute the rates of activities for different cost pools within an Activity-Based Costing system.

- Calculate customer margins utilizing Activity-Based Costing data.

Related questions

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

Greife Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...