Asked by kyaira jackson on May 16, 2024

Verified

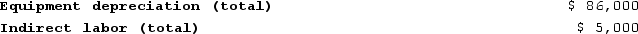

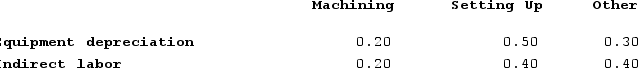

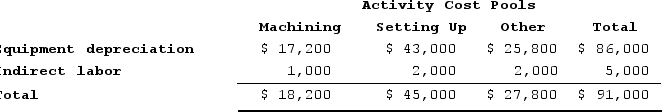

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

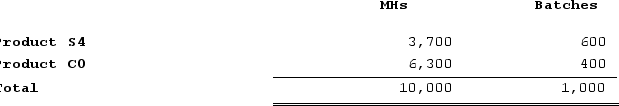

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

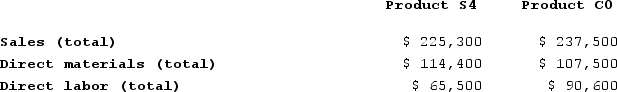

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Activity Cost Pools

Categories in activity-based costing where costs are accumulated before being assigned to products or services based on their consumption of activities.

Machine-Hours

A measure of the amount of time machines are used in the production process, often used for allocating manufacturing overhead.

Batches

Quantities of material or products processed or produced at the same time in a manufacturing process.

- Attain an understanding of the principles behind Activity-Based Costing (ABC).

- Ascertain the rates of activities across diverse cost pools in an Activity-Based Costing framework.

- Distribute indirect costs among products using established activity rates.

Verified Answer

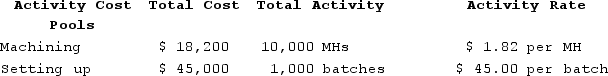

b.Computation of activity rates:

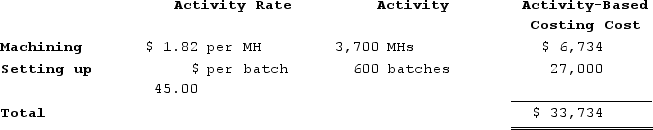

b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4:

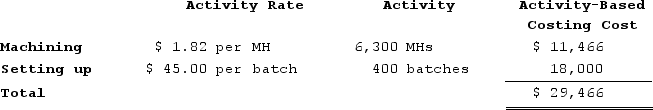

c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0:

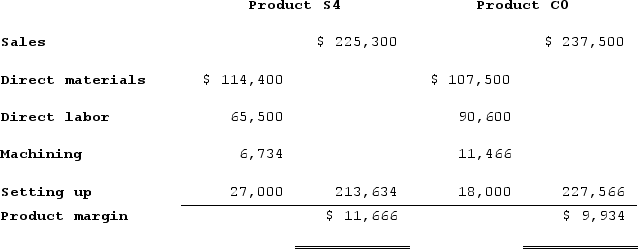

Overhead cost for Product C0: d.Determine product margins:

d.Determine product margins:

Learning Objectives

- Attain an understanding of the principles behind Activity-Based Costing (ABC).

- Ascertain the rates of activities across diverse cost pools in an Activity-Based Costing framework.

- Distribute indirect costs among products using established activity rates.

Related questions

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Desjarlais Corporation Uses the Following Activity Rates from Its Activity-Based ...

EMD Corporation Manufactures Two Products, Product S and Product W ...

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...