Asked by Cassandra Alcantar on Apr 26, 2024

Verified

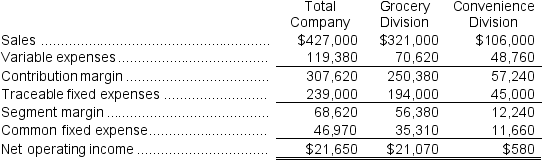

Kneeland Corporation has two divisions: Grocery Division and Convenience Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.

The common fixed expenses have been allocated to the divisions on the basis of sales.

Required:

a.What is the Grocery Division's break-even in sales dollars?

b.What is the Convenience Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

d.What would be the company's overall net operating income if the company operated at its two division's break-even points?

Break-even

The point at which total revenues equal total expenses, resulting in no net profit or loss.

Sales Dollars

The total revenue generated from the sale of goods or services, expressed in monetary units.

Net Operating Income

Income from a company's core business operations, excluding expenses such as taxes, interest, and extraordinary items.

- Compute the break-even points for both individual divisions and the entire organization.

- Gain an understanding of how common fixed expenses are apportioned among divisions.

Verified Answer

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $250,380 ÷ $321,000 = 0.780

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $194,000 ÷ 0.780 = $248,718

b.Convenience Division break-even:

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $57,240 ÷ $106,000 = 0.540

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $45,000 ÷ 0.540 = $83,333

c.The company's overall break-even sales:

CM ratio = Contribution margin ÷ Sales

= $307,620 ÷ $427,000 = 0.720 (rounded)

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $239,000 + $46,970 = $285,970

Dollar sales to break even = Total fixed expenses ÷ CM ratio

= $285,970 ÷ 0.720 = $396,948 (using the unrounded CM ratio)

d.If the company operates at the break-even points for its two divisions, it will have a net operating loss of $46,970 because it will not cover its common fixed expense of $46,970.

Learning Objectives

- Compute the break-even points for both individual divisions and the entire organization.

- Gain an understanding of how common fixed expenses are apportioned among divisions.

Related questions

Clouthier Corporation Has Two Divisions: Home Division and Commercial Division ...

Petteway Corporation Has Two Divisions: Home Division and Commercial Division ...

Fausnaught Corporation Has Two Major Business Segments--Retail and Wholesale ...

Delisa Corporation Has Two Divisions: Division L and Division Q ...

Holts Corporation Has Two Divisions: Xi and Sigma ...