Asked by Komal Klair on Jul 06, 2024

Verified

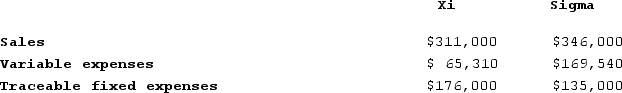

Holts Corporation has two divisions: Xi and Sigma. Data from the most recent month appear below:  The company's common fixed expenses total $78,840. The break-even in sales dollars for the company as a whole is closest to:

The company's common fixed expenses total $78,840. The break-even in sales dollars for the company as a whole is closest to:

A) $487,491

B) $606,715

C) $466,018

D) $119,225

Common Fixed Expenses

Costs that remain constant regardless of the volume of goods produced or sold, including items like lease payments, wages, and coverage fees.

Break-Even

The point at which total costs equal total revenue, resulting in neither profit nor loss.

Sales Dollars

The total monetary amount received from selling goods or services before any deductions are made.

- Evaluate the break-even points for specific divisions and the comprehensive corporate entity.

Verified Answer

For division Xi:

Contribution margin ratio = (Total sales - Variable expenses) / Total sales

= (($335,000 - $147,000) - $42,400) / $335,000

= $145,600 / $335,000

= 0.4358 or 43.58%

For division Sigma:

Contribution margin ratio = (Total sales - Variable expenses) / Total sales

= (($487,000 - $299,600) - $28,800) / $487,000

= $158,600 / $487,000

= 0.3253 or 32.53%

Next, we can use the formula:

Break-even point = Common fixed expenses / Weighted average contribution margin ratio

The weighted average contribution margin ratio is calculated by weighting each division's contribution margin ratio by its proportion of total sales.

Weighted average contribution margin ratio = (Division Xi sales / Total sales) x (Contribution margin ratio for Xi) + (Division Sigma sales / Total sales) x (Contribution margin ratio for Sigma)

= ($335,000 / $822,000) x 0.4358 + ($487,000 / $822,000) x 0.3253

= 0.2035 + 0.2415

= 0.4450 or 44.50%

Plugging in the numbers:

Break-even point = $78,840 / 0.4450

= $177,369.67

Therefore, the closest answer choice is B) $606,715

Learning Objectives

- Evaluate the break-even points for specific divisions and the comprehensive corporate entity.

Related questions

Delisa Corporation Has Two Divisions: Division L and Division Q ...

Therrell Corporation Has Two Divisions: Bulb Division and Seed Division ...

Clouthier Corporation Has Two Divisions: Home Division and Commercial Division ...

Kneeland Corporation Has Two Divisions: Grocery Division and Convenience Division ...

Petteway Corporation Has Two Divisions: Home Division and Commercial Division ...