Asked by Genna Greco on Jun 03, 2024

Verified

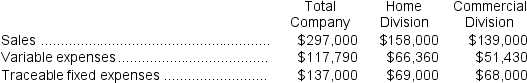

Clouthier Corporation has two divisions: Home Division and Commercial Division.The following report is for the most recent operating period:  The company's common fixed expenses total $29,700.

The company's common fixed expenses total $29,700.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

Break-even

The point at which total revenues equal total costs, resulting in no net loss or gain.

Sales Dollars

The total monetary value of sales transactions made within a specific period, reflecting the revenue generated from selling goods or services.

Common Fixed Expenses

Regular, unchanged expenses that a business incurs, regardless of the level of production or sales volume.

- Evaluate the break-even points for specific divisions as well as the complete corporation.

Verified Answer

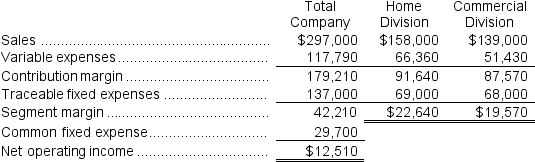

a.Home Division break-even:

a.Home Division break-even:Segment CM ratio = Segment contribution margin ÷ Segment sales

= $91,640 ÷ $158,000 = 0.580

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $69,000 ÷ 0.580 = $118,966

b.Commercial Division break-even:

Segment CM ratio = Segment contribution margin ÷ Segment sales

= $87,570 ÷ $139,000 = 0.630

Dollar sales for a segment to break even = Traceable fixed expenses ÷ Segment CM ratio

= $68,000 ÷ 0.630 = $107,937

c.The company's overall break-even sales:

CM ratio = Contribution margin ÷ Sales

= $179,210 ÷ $297,000 = 0.603 (rounded)

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $137,000 + $29,700 = $166,700

Dollar sales to break even = Total fixed expenses ÷ CM ratio

= $166,700 ÷ 0.603 = $276,268 (using the unrounded CM ratio)

Learning Objectives

- Evaluate the break-even points for specific divisions as well as the complete corporation.

Related questions

Kneeland Corporation Has Two Divisions: Grocery Division and Convenience Division ...

Petteway Corporation Has Two Divisions: Home Division and Commercial Division ...

Holts Corporation Has Two Divisions: Xi and Sigma ...

Delisa Corporation Has Two Divisions: Division L and Division Q ...

Therrell Corporation Has Two Divisions: Bulb Division and Seed Division ...