Asked by Bethany Allen on Jul 01, 2024

Verified

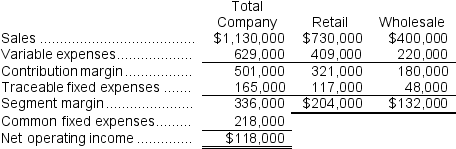

Fausnaught Corporation has two major business segments--Retail and Wholesale.In October, the Retail business segment had sales revenues of $730,000, variable expenses of $409,000, and traceable fixed expenses of $117,000.During the same month, the Wholesale business segment had sales revenues of $400,000, variable expenses of $220,000, and traceable fixed expenses of $48,000.Common fixed expenses totaled $218,000 and were allocated as follows: $122,000 to the Retail business segment and $96,000 to the Wholesale business segment.

Required:

Prepare a segmented income statement in the contribution format for the company.Omit percentages; show only dollar amounts.

Contribution Format

A method of income statement presentation where all variable costs are subtracted from sales to find the contribution margin, followed by the deduction of fixed costs to determine net operating income.

Traceable Fixed Expenses

Fixed costs directly associated with a specific department or product, which would disappear if the department or product were eliminated.

- Formulate segmented income statements and evaluate the effectiveness of each division.

- Familiarize oneself with the process of allocating common fixed expenses to different divisions.

Verified Answer

Learning Objectives

- Formulate segmented income statements and evaluate the effectiveness of each division.

- Familiarize oneself with the process of allocating common fixed expenses to different divisions.

Related questions

Kneeland Corporation Has Two Divisions: Grocery Division and Convenience Division ...

Petteway Corporation Has Two Divisions: Home Division and Commercial Division ...

Omstadt Corporation Produces and Sells Only Two Products That Are ...

Corbel Corporation Has Two Divisions: Division a and Division B ...

Corbel Corporation Has Two Divisions: Division a and Division B ...