Asked by Larissa Vanolli on Jun 17, 2024

Verified

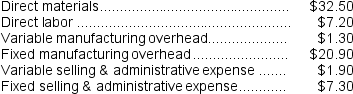

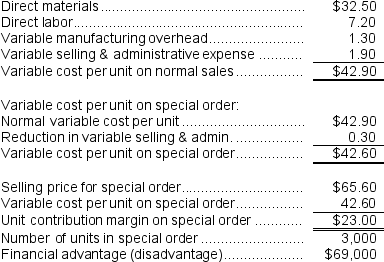

Juliani Company produces a single product.The cost of producing and selling a single unit of this product at the company's normal activity level of 50,000 units per month is as follows:  The normal selling price of the product is $75.00 per unit.

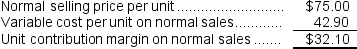

The normal selling price of the product is $75.00 per unit.

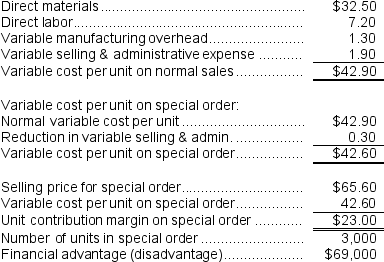

An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price.This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs.The variable selling and administrative expense would be $0.30 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

Required:

a.Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $65.60 per unit.What is the financial advantage (disadvantage)for the company next month if it accepts the special order?

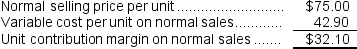

b.Suppose the company is already operating at capacity when the special order is received from the overseas customer.What would be the opportunity cost of each unit delivered to the overseas customer?

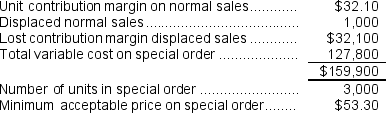

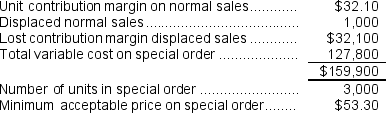

c.Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1,000 units for regular customers.What would be the minimum acceptable price per unit for the special order?

Special Discounted Price

A reduced price offered on goods or services, lower than the standard charge to promote sales.

Variable Selling

Refers to costs that vary directly with the level of sales, such as commissions or shipping fees.

Idle Capacity

The portion of a company's resources, such as labor or machinery, that is not being used to its full potential during the production process.

- Assess particular orders to delineate their financial repercussions.

- Calculate and interpret product costs and pricing.

Verified Answer

LT

Lamar TossilsJun 22, 2024

Final Answer :

a.

Variable cost per unit on normal sales: b.The opportunity cost is just the contribution margin on normal sales:

b.The opportunity cost is just the contribution margin on normal sales:  c.Minimum acceptable price:

c.Minimum acceptable price:

Variable cost per unit on normal sales:

b.The opportunity cost is just the contribution margin on normal sales:

b.The opportunity cost is just the contribution margin on normal sales:  c.Minimum acceptable price:

c.Minimum acceptable price:

Learning Objectives

- Assess particular orders to delineate their financial repercussions.

- Calculate and interpret product costs and pricing.