Asked by Beatriz Lozano on Apr 29, 2024

Verified

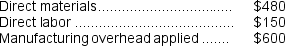

Juanita Corporation uses a job-order costing system and applies overhead on the basis of direct labor cost.At the end of October, Juanita had one job still in process.The job cost sheet for this job contained the following information:  An additional $100 of labor was needed in November to complete this job.For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?

An additional $100 of labor was needed in November to complete this job.For this job, how much should Juanita have transferred to finished goods inventory in November when it was completed?

A) $1,330

B) $500

C) $1,230

D) $1,730

Direct Labor Cost

The expense associated with labor directly involved in the production of goods or services, excluding indirect labor costs.

Overhead

A broader category of ongoing expenses not directly tied to specific products or services but essential for the business's day-to-day operations.

- Acquire knowledge on the assignment of manufacturing overhead costs to particular jobs utilizing established overhead rates.

- Appraise the dispersion of manufacturing overhead to distinct job tasks and comprehend the implications for job costing strategies.

Verified Answer

AH

Austin HalfacreApr 29, 2024

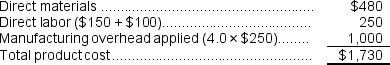

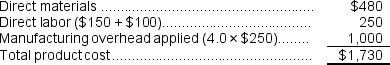

Final Answer :

D

Explanation :

Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred

$600 = Predetermined overhead rate × $150

Predetermined overhead rate = $600 ÷ $150 = 4.0

$600 = Predetermined overhead rate × $150

Predetermined overhead rate = $600 ÷ $150 = 4.0

Learning Objectives

- Acquire knowledge on the assignment of manufacturing overhead costs to particular jobs utilizing established overhead rates.

- Appraise the dispersion of manufacturing overhead to distinct job tasks and comprehend the implications for job costing strategies.

Related questions

Gilchrist Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

Coates Corporation Uses a Job-Order Costing System with a Single ...

Stockmaster Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Parido Corporation Has Two Manufacturing Departments--Casting and Assembly ...

Doakes Corporation Uses a Job-Order Costing System with a Single ...