Asked by Enrique Cuevas on Jul 03, 2024

Verified

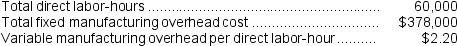

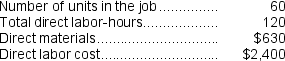

Doakes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours.The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M843 was completed with the following characteristics:

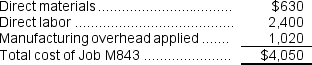

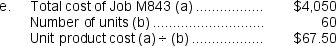

Recently, Job M843 was completed with the following characteristics:  The unit product cost for Job M843 is closest to:

The unit product cost for Job M843 is closest to:

A) $33.75

B) $67.50

C) $27.50

D) $50.50

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated by dividing estimated overhead costs by an allocation base.

Direct Labor-Hours

The total hours worked by employees who are directly involved in the production process, used as a basis for allocating costs to products.

- Evaluate the distribution of manufacturing overhead to specific tasks and appreciate its impact on the calculation of job costs.

Verified Answer

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $510,000 ÷ 60,000 direct labor-hours = $8.50 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $8.50 per direct labor-hour × 120 direct labor-hours = $1,020

Learning Objectives

- Evaluate the distribution of manufacturing overhead to specific tasks and appreciate its impact on the calculation of job costs.

Related questions

Stockmaster Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Juanita Corporation Uses a Job-Order Costing System and Applies Overhead ...

Parido Corporation Has Two Manufacturing Departments--Casting and Assembly ...

Coates Corporation Uses a Job-Order Costing System with a Single ...

Leisure Life Manufactures a Variety of Sporting Equipment ...