Asked by Olivia Davis on Apr 25, 2024

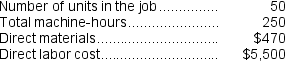

Coates Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $249,000, variable manufacturing overhead of $3.80 per machine-hour, and 30,000 machine-hours.The company has provided the following data concerning Job X784 which was recently completed:  If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

A) $253.87

B) $233.87

C) $53.97

D) $155.22

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to products based on a predetermined formula.

Variable Manufacturing Overhead

Costs that vary proportionally with manufacturing activity, such as indirect materials and utilities.

Markup

The amount added to the cost of goods to cover operating expenses and profit, expressed as a percentage of cost.

- Compute the allocation of manufacturing overhead to particular jobs and comprehend its effect on job costing.

- Compute and analyze the selling price of projects utilizing cost-plus pricing approaches and manufacturing overhead rates.

Learning Objectives

- Compute the allocation of manufacturing overhead to particular jobs and comprehend its effect on job costing.

- Compute and analyze the selling price of projects utilizing cost-plus pricing approaches and manufacturing overhead rates.

Related questions

Stockmaster Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Parido Corporation Has Two Manufacturing Departments--Casting and Assembly ...

Doakes Corporation Uses a Job-Order Costing System with a Single ...

Juanita Corporation Uses a Job-Order Costing System and Applies Overhead ...

Leisure Life Manufactures a Variety of Sporting Equipment ...