Asked by Veronika Khvan on May 31, 2024

Verified

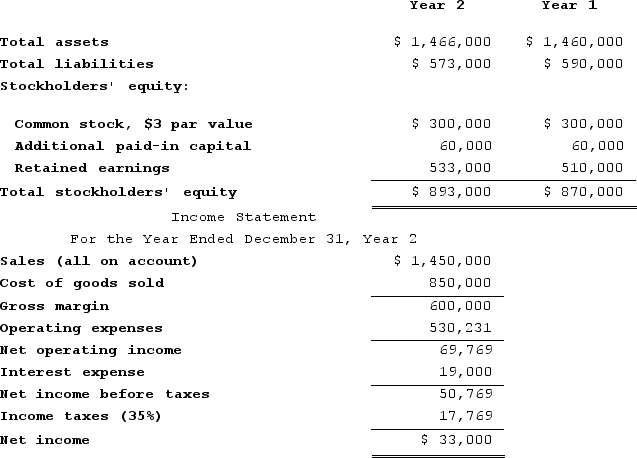

Jaquez Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?

Times Interest Earned

A financial metric indicating how many times a company can cover its interest obligations with its earnings before interest and taxes.

Debt-To-Equity Ratio

A financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets, used as a measure of financial health.

Equity Multiplier

This financial ratio measures a company's leverage by comparing its total assets to its total shareholders' equity.

- Analyze a company's financial health through its profitability ratios.

- Assess leverage and risk using debt and equity ratios.

- Understand how to calculate and interpret basic financial ratios.

Verified Answer

Learning Objectives

- Analyze a company's financial health through its profitability ratios.

- Assess leverage and risk using debt and equity ratios.

- Understand how to calculate and interpret basic financial ratios.

Related questions

Perrett Corporation Has Provided the Following Financial Data ...

Moselle Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...

Fraction Corporation Has Provided the Following Financial Data ...

Lindboe Corporation Has Provided the Following Financial Data ...