Asked by Chloe Francis on Jun 29, 2024

Verified

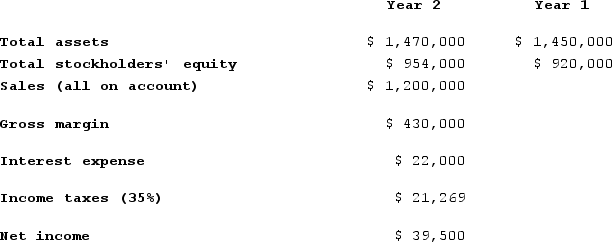

Perrett Corporation has provided the following financial data:

Required:a. What is the company's net profit margin percentage for Year 2?b. What is the company's gross margin percentage for Year 2?c. What is the company's return on total assets for Year 2?d. What is the company's return on equity for Year 2?

Required:a. What is the company's net profit margin percentage for Year 2?b. What is the company's gross margin percentage for Year 2?c. What is the company's return on total assets for Year 2?d. What is the company's return on equity for Year 2?

Net Profit Margin

A financial ratio that shows the percentage of net income generated from total revenue.

Gross Margin

The difference between sales revenue and the cost of goods sold, representing the profitability before deducting operating expenses.

Return On Total Assets

A financial ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets.

- Determine a firm's financial status by evaluating its profitability ratios.

- Determine and gauge a corporation's equity and asset return rates.

Verified Answer

Learning Objectives

- Determine a firm's financial status by evaluating its profitability ratios.

- Determine and gauge a corporation's equity and asset return rates.

Related questions

Brill Corporation Has Provided the Following Financial Data ...

Lindboe Corporation Has Provided the Following Financial Data ...

Degollado Corporation's Most Recent Income Statement Appears Below ...

Jaquez Corporation Has Provided the Following Financial Data ...

If Management Wishes to Evaluate the Ability of a Business ...